On April 8, 2021, the UCA College of Business held its annual Student Honors Banquet to celebrate the academic achievements of the College’s students and recognize the outstanding students for the 2020-2021 academic year.

Outstanding students are those who take advantage of educational opportunities and show exemplary academic performance through internships, professional development and experiential education, volunteerism, and participation in clubs and activities.

The following students were awarded an outstanding status, chosen from over 1600 undergraduate and graduate students:

- Ashley Phipps, Outstanding General Business Student

- Bethany Arnold, Outstanding Insurance & Risk Management Student

- Brandon Scott Phipps, Outstanding Master of Business Student

- Claire DeBusk, Outstanding Accounting Student

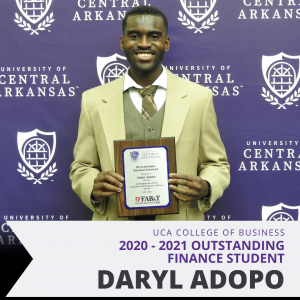

- Daryl Adopo, Outstanding Finance Student

- Devin Gilbert, Outstanding Master of Accountancy Student

- Elsa Mattson, Outstanding College of Business Student and Outstanding Economic Student

- Emma McKnight, Outstanding Marketing Student

- Jack Bornhoft, Outstanding Logistics & Supply Chain Management Student

- Kayla Dean, Outstanding Management Information Systems Student

- Lucas Southard, Outstanding Management Student

- Laura Lane, Outstanding Marketing Student

- Logan Tribble, Outstanding Innovation & Entrepreneurship Student

- Rohan Saxena, Outstanding Information Systems Student

OUTSTANDING STUDENT FOR THE COLLEGE OF BUSINESS: ELSA MATTSON

A triple major with a 3.95 GPA, Elsa earned a BBA in Economics with International Trade Concentration, a BBA in Management Information Systems with a Business Analysis Concentration, and a BA in Chinese. Elsa also earned a Certified Associate in Project Management (CAPM). As a Research Fellow for the Arkansas Center for Research in Economics (ACRE) for two years, she published a refereed journal article about occupational licensing requirements and its effect on workers during the Great Recession; published an Op-ed about Pennsylvania’s licensing requirements, which was noticed by their Governor’s office; and presented her studies at the International Academy of Business Disciplines conference. She also earned a Mainframe Apprenticeship at Ensono in summer 2020. She served as President of Team Global at UCA and was selected to represent the College at recruiting and accreditation events during her senior year. Elsa will begin a Master of Science in Business Analytics at William & Mary on a merit-based scholarship starting in the fall. |

|

|

ACCOUNTINGOUTSTANDING MASTER OF ACCOUNTANCY STUDENT: DEVIN GILBERT

After graduation with his Master of Accountancy (MAcc), Devin is going to work for PricewaterhouseCoopers, the largest accounting firm in the world. |

OUTSTANDING ACCOUNTING STUDENT: CLAIRE DeBUSK

|

|

|

ECONOMICS, FINANCE, AND INSURANCE & RISK MANAGEMENTOUTSTANDING ECONOMICS STUDENT: ELSA MATTSON

|

OUTSTANDING FINANCE STUDENT: DARYL ADOPO

|

OUTSTANDING INSURANCE & RISK MANAGEMENT STUDENT: BETHANY ARNOLD

|

|

|

MANAGEMENT INFORMATION SYSTEMSOUTSTANDING GENERAL BUSINESS STUDENT: ASHLEY PHIPPS

|

OUTSTANDING MANAGEMENT INFORMATION SYSTEMS STUDENT: KAYLA DEAN

|

OUTSTANDING INFORMATION SYSTEMS STUDENT: ROHAN SAXENA

|

|

|

MARKETING & MANAGEMENTOUTSTANDING INNOVATION & ENTREPRENEURSHIP STUDENT: LOGAN TRIBBLE

|

OUTSTANDING LOGISTICS & SUPPLY CHAIN MANAGEMENT STUDENT: JACK BORNHOFT

|

OUTSTANDING MANAGEMENT STUDENT: LUCAS SOUTHARDLucas Southard has 3.84 GPA as he works toward a BBA in Management with a concentration in Human Resources Management. |

OUTSTANDING MARKETING STUDENT: LAURA LANE & EMMA McKNIGHT

|

|

|

OUTSTANDING MASTER OF BUSINESS ADMINISTRATION STUDENT: BRANDON SCOTT PHIPPS

|

|

|

ABOUT THE COLLEGE OF BUSINESS

The UCA College of Business includes:

- Over 1600 Majors and Graduate Students

- 62 Total Faculty

- 15 Undergraduate Degree Programs

- 3 Graduate Degree Programs (MBA, MAcc, and Graduate Certificate in Data Analytics)

The goal of the UCA College of Business is to provide a hands-on, experience driven, education that prepares graduates to take on global issues. Through our diverse programs of study and distinguished faculty and staff, we take creative, engaged students and give them the tools to succeed when they earn their degrees. Our students travel the world, start their own innovative businesses, and join established businesses across the country. Whatever their next step, our students are ready to make a positive impact.

Learn more about our programs of study and distinguished faculty and staff.

Our new Dean,

Our new Dean,

Accounting majors

Accounting majors  Jason Brown (student),

Jason Brown (student),

UCA’s Center for Insurance Director,

UCA’s Center for Insurance Director,

This spring UCA Accounting majors participated in the Volunteer Income Tax (VITA) program at United Way of Central Arkansas (UWCA). The VITA program delivers financial support to hundreds of families across Central Arkansas through free tax preparation and filing services. Students participate in this program each year with mentorship from

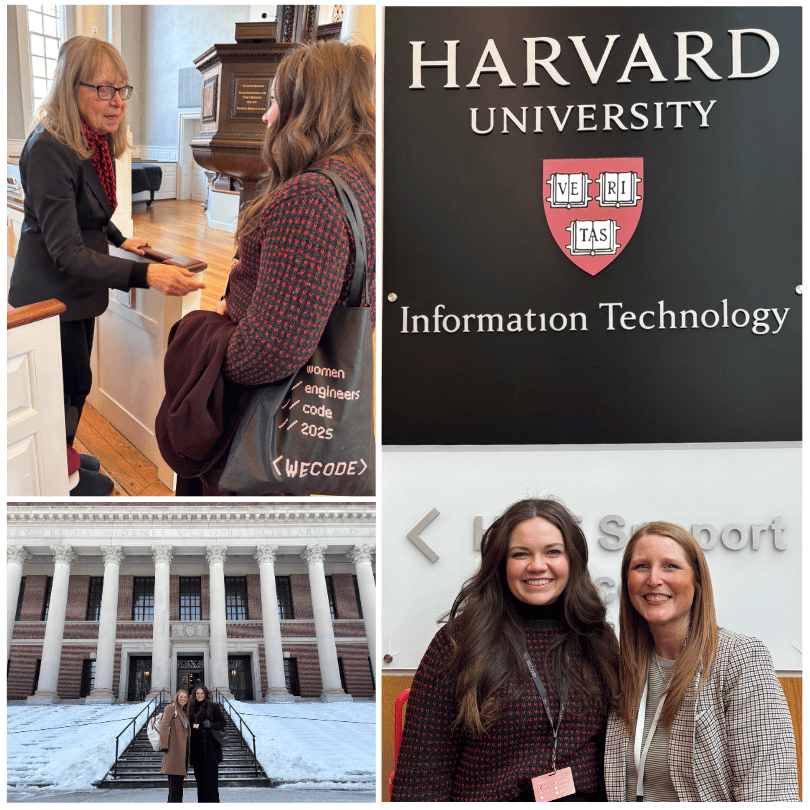

This spring UCA Accounting majors participated in the Volunteer Income Tax (VITA) program at United Way of Central Arkansas (UWCA). The VITA program delivers financial support to hundreds of families across Central Arkansas through free tax preparation and filing services. Students participate in this program each year with mentorship from  Rebecca Thomas is a senior set to Graduate Summa Cum Laude in May 2025. During her time at UCA, Rebecca has combined her education in the classroom with internships, research, and volunteerism in the community.

Rebecca Thomas is a senior set to Graduate Summa Cum Laude in May 2025. During her time at UCA, Rebecca has combined her education in the classroom with internships, research, and volunteerism in the community.