(Conway, AR) – Dr. Jeremy Horpedahl, Associate Professor of Economics at the University of Central Arkansas (UCA) College of Business, has been recognized for his work to provide accurate coronavirus information and dispel misinformation during the COVID-19 pandemic. The award comes from the Mercatus Center at George Mason University, which announced on Sunday its ten most recent winners across North America.

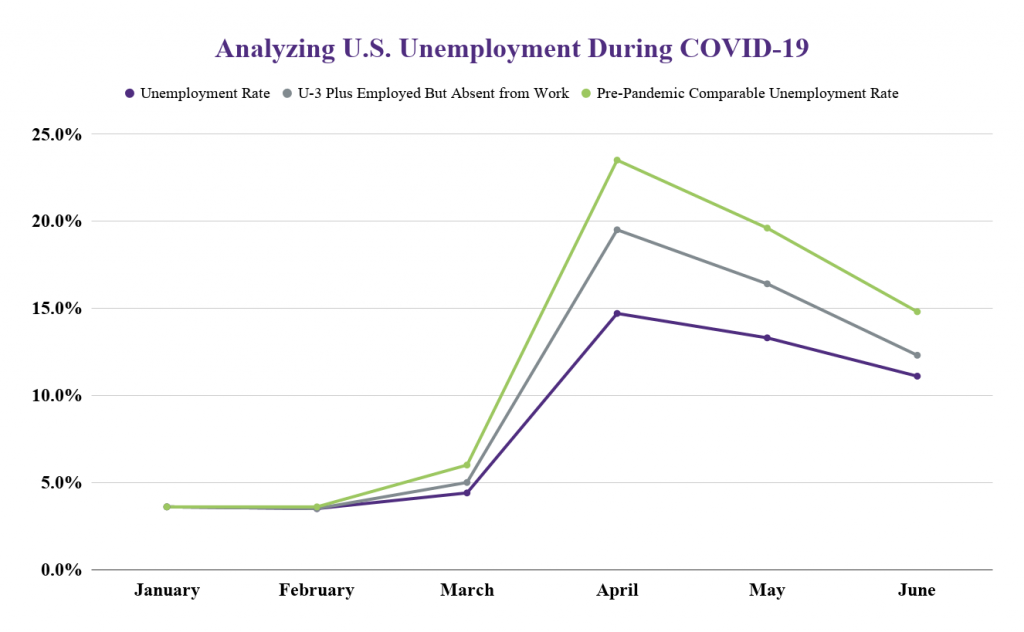

Dr. Horpedahl won the prize for his policy and data analysis on pandemic-related economic topics such as coronavirus precautions, tolls and trends, vaccination development and distribution, unemployment, as well as local, national, and worldwide financial impacts.

Dr. Horpedahl won the prize for his policy and data analysis on pandemic-related economic topics such as coronavirus precautions, tolls and trends, vaccination development and distribution, unemployment, as well as local, national, and worldwide financial impacts.

“Part of what motivated me was simply to understand the pandemic better myself, and I was glad to help others navigate the same questions that I had about the state of the world,” said Dr. Horpedahl.

Horpedahl was also a co-recipient of another award from the Mercatus Center for the blog EconomistWritingEveryDay.com, where he is a weekly contributor.

“Dr. Horpedahl’s efforts to communicate complex topics in a more approachable way has helped inform and educate others about economic policy. This is important work during an already confusing and stressful time, and we are proud of his effort and impact,” added Dr. Michael Hargis, Dean of the UCA College of Business. [Read more…]