By Jeremy Horpedahl, ACRE Director and UCA Associate Professor of Economics

The first “Extraordinary Session,” or special session, of the 2023 Arkansas General Assembly will once again take up the important issue of tax reform. The proposed bill HB1007 (and the companion bill SB8) makes three changes to Arkansas tax law. First, the top personal income tax rate will be reduced from 4.7 to 4.4 percent. Second, the top corporate income tax rate will be reduced from 5.1 to 4.8 percent. Finally, a one-time tax credit of $150 will be given to Arkansas taxpayers with taxable income under $90,000 (the credit will phase-out after that). The rate changes take effect in 2024, and the $150 credit is for 2023.

By permanently reducing the personal and corporate income tax rates, the legislature would achieve another goal of “right sizing” the Arkansas tax system for current spending levels. After three years of budget surpluses close to $1 billion or more, it is clear that Arkansas’s state tax system raises more revenue than the current legislature wants to spend. While the days of billion dollar surpluses are probably over, the Department of Finance & Administration’s revenue forecast for the current fiscal year suggests there could be a surplus of around $400 million this year. Reducing income taxes again will help to better align tax revenue with the spending priorities of the legislature.

The proposed tax reductions will have a fiscal cost of about $200 million per year going forward, and almost $100 million in the current fiscal year (which will be half over by the time the tax cuts take effect). But what do these million dollar numbers mean to a typical taxpaying family in Arkansas? About one year ago, ACRE analyzed the cumulative effect of the tax cuts enacted from 2015 to 2022 on sample taxpayers in Arkansas, finding that for middle-class families the tax cuts could mean somewhere between $400 and $1,000 in savings per year, every year going into the future. High-income taxpayers will benefit even more, potentially attracting highly productive individuals and businesses to Arkansas from other low-tax jurisdictions.

We can extend that analysis to incorporate the proposed special session tax cuts, and the tax cuts enacted in the regular 2023 session this past spring. The cumulative effect would be to take the top income tax rate down from 4.9 percent, which is where it was prior to 2023, down to 4.4 percent. Keep in mind that this rate doesn’t only apply to high-income Arkansans anymore, as thanks to past tax reforms the top tax rate now kicks in at $24,300 of taxable income in 2023 (this amount is adjusted up slightly each year for inflation). Individuals with taxable income under that threshold won’t see any direct benefit from these tax reductions, though they will benefit from the one-time $150 payment in this proposed legislation.

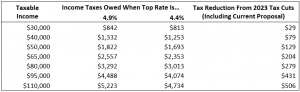

The following table shows sample taxpayers and their tax reductions from the 2023 tax cuts (including the proposed special session tax reduction).

For example, the table shows that an Arkansas taxpayer with $50,000 of taxable income would have their income taxes reduced by $129 per year. That’s in addition to the one-time $150 tax reduction. Also keep in mind that because Arkansas allows for separate filing of married couples, these should be thought of as sample individual taxpayers, not families. A family with two earners each with $50,000 of taxable income would receive double the $129 tax cut.

For some taxpayers, the reductions in taxes from this one tax will not be especially large, but when we take a long-term perspective – including both the past tax reductions since 2015 and the potential for future tax reductions – Arkansans across the income distribution will be seeing a lot more take-home income on their pay stubs next year and into the future.