by Joseph Johns, ACRE Policy Analyst

The Arkansas General Assembly has been making historic strides toward reducing the cost of living for Arkansas families. Following the tax changes made in a special session last month, Governor Hutchinson has now enacted a total of five tax cut packages during his administration. The top marginal income tax rate on personal income in Arkansas is now down to 4.9 percent, lower than it has ever been since Arkansas enacted its income tax in 1929 — it was originally 5 percent and raised to 7 percent in the 1970s. The Natural State has allowed taxpayers to keep roughly $680 million annually with the changes made since 2015 as a result of these successive tax reforms. These numbers are sometimes difficult to grasp, given their enormity. Given these large figures, it’s important to consider the impact from the standpoint of those who benefit, namely everyday Arkansans.

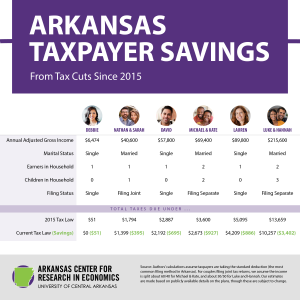

The graphic below shows the total tax burden for six representative Arkansas families prior to 2015, when the first of five tax cut plans were passed (see the line “2015 Tax Law”). In other words, this first table shows what taxes for different Arkansas families would be if tax rates had never changed (other than the usual adjustment of brackets for inflation).

Fast forward seven years and the picture looks much better for even the lowest income Arkansans. Under current tax law (the last line in the graphic), a household earning near the state median income of around $50,000 saved almost $700 total from the five the tax cuts implemented under the Hutchinson administration. Keep in mind that this $700 is not just a one-time tax cut: taxes will now be lower every year into the future.

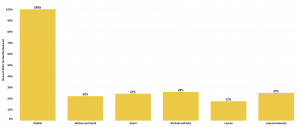

The most straightforward way to conceptualize the changes made is to show the savings as a percentage of each families’ 2015 tax burden. The bar chart below shows the percent of the 2015 tax burden absorbed by the five successive tax cuts for each of these seven family types.

Chart I: Realized Tax Savings

The bar chart above shows that savings across the income spectrum vary between 100 percent for low-income tax payers such as Debbie, who earned $6,747 in 2022 and 17.4 percent for relatively high-income taxpayers such as Lauren, who earned $89,800 in 2022. The majority of the tax cuts were focused on reducing tax rates for low to middle income earners. This implies that everyday Arkansans will benefit the most from the lowest individual income tax rate in state history. While the $51 tax cut for the lowest income family is small, it’s important to keep in mind that it completely removes this taxpayer’s income tax liability. They didn’t owe much income tax to begin with, and now they don’t owe any income tax.

Inflation Raises Taxes on Arkansans

Arkansas has made significant reforms over the past seven years and should continue to look at further incremental reforms to eliminate the individual income tax altogether. One idea for a minor change that could have significant effects is to allow Arkansas’s individual income tax brackets to be fully adjustable to inflation. Currently, Arkansas allows its income tax tables (as well as standard deduction) to be adjusted to the inflation rate as long as it remains at or below 3 percent. According to the Tax Foundation, annual inflation as defined in the Consumer Price Index (CPI) only exceeded 3 percent five times in the past 20 years (and these were not by much), and Arkansas is one of only two states to cap inflation adjustments in this way.

Since inflation has exceeded 3 percent since April 2021, Arkansas taxpayers experienced a phenomenon known as bracket creep. This occurs when income tax brackets remain unchanged in the midst of high inflation and results in diminished purchasing power since their incomes are taxed according to their nominal, rather than their real (inflation-adjusted) value. In other words, taxes on Arkansans’ real income will increase because our tax system isn’t keeping up with inflation. With current inflation rates around 8 or 9 percent, Arkansans would experience very large tax increases from “bracket creep” in the years ahead, as our incomes continue to rise along with price inflation, we will get pushed up into higher tax brackets.

To avoid bracket creep, Arkansas needs to change its tax code to be fully inflation-adjusted, rather than being capped at 3 percent. These changes would allow Arkansans to keep even more of their hard-earned incomes and build on the tax reforms of past sessions. It’s especially important right now, given the very high rate of inflation that the country is experiencing. Rep. David Ray of the Arkansas legislature recently informed ACRE that he plans to run a bill at the next legislative session to remove this 3 percent cap, which will prevent bracket creep and hidden tax increases for Arkansans in the future (Rep. Ray was the lead sponsor of a bill in 2021 to index the standard deduction to CPI inflation, which didn’t pass at the time but was incorporated into the major tax package of the December 2021 special session).

Regardless of how Arkansas legislators choose to move forward, ACRE staff will continue to inform the debate and support any effort that builds upon the historic tax cuts implemented by the Hutchinson administration