By Jeremy Horpedahl, ACRE Director

Beginning in 2015, Arkansas has been making gradual reductions in both personal and corporate income tax rates. The cumulative personal income tax reductions could be saving middle-income families in Arkansas $2,000-$5,000 every year, as an analysis by ACRE Policy Analyst Joseph Johns shows. Not only has the top income tax rate been reduced for individuals and families, but many lower rates have been cut as well. The corporate tax rate has been reduced from 6.5% to 5.3%, along with other important changes to the structure of the corporate tax code.

These changes have clearly benefited Arkansan citizens and businesses, but have these tax cuts greatly reduced available state revenue? This concern is potentially real, since income taxes make up over half of state general revenue in Arkansas. It could also be a concern moving forward, as the legislature considers further tax cuts in the current legislative session.

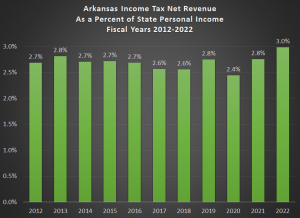

Despi te these concerns, the data so far shows that there has been no reduction in income tax revenue in Arkansas. The best way to measure how much tax revenue is being collected is to express it as a percent of personal income in the state. If tax revenue was being significantly affected by the tax changes since 2015, we would expect this number to decline.

te these concerns, the data so far shows that there has been no reduction in income tax revenue in Arkansas. The best way to measure how much tax revenue is being collected is to express it as a percent of personal income in the state. If tax revenue was being significantly affected by the tax changes since 2015, we would expect this number to decline.

The tax revenue data in the chart comes from the Arkansas Bureau of Legislative Research in their “B Book” publication. Personal income data is from the US Bureau of Economic Analysis. Both are expressed for the fiscal years, which run from start in the third quarter of the year (e.g., Fiscal Year 2022 ran from July 2021 to June 2022).

While there is some fluctuation from year-to-year, this figure has stayed right around 2.7% since 2015, which is the average both before and after the tax changes began. We all know why 2020 was an unusual year and revenue was down slightly, but 2022 also proved to be an above-average year as the economy began to return to normal.

The chart above is not adjusted for price inflation, because it doesn’t need to be. Both tax revenue and personal income are expressed in nominal dollars from the same time period, so it is adjusted for the size of the economy. But we could also adjust the tax revenue data for inflation to make sure it is growing each year, which is what the table below shows (all dollars expressed in January 2022 dollars).

We can see that even after adjusting for inflation, total income tax revenue in Arkansas was over $700 million greater in 2022 than it was in 2015, before the tax reductions began.

That’s all good news for Arkansas, both for taxpayers and the state budget. But it might seem surprising. How can tax revenue continue to increase when taxes are being cut?

The overriding reason these tax reductions haven’t lowered total revenue very much is that these tax cuts were small compared with the overall budget. While the cumulative amount is somewhere around $680 million, this total was phased-in over multiple fiscal years. During most years, the total new reductions were somewhere around $100 or $200 million, or less than 5% of income tax revenue and an even smaller share of the total general revenue budget. Gradually reducing income tax rates has meant there is never a large hit to the state budget, since tax revenue tends to grow every year anyway along with the economy growing. Adjusted for inflation, the Arkansas economy was almost 12% larger in FY 2022 than it was in FY 2015.

Another reason is that there will be some positive impact on economic growth from these tax cuts. Economists sometimes refer to the dynamic cost of a tax cut, which is different from the static cost. The static cost (such as the $680 million estimate from Gov. Hutchinson) assumes that people’s behavior doesn’t change in response to the tax changes. But changing behavior, such as encouraging work and business formations, is one of the policy goals of lowering taxes. If people do change their behavior, the dynamic cost will be less than the static cost, since more economic activity partially offsets the lower tax revenue.

Dynamic scoring is often challenging to do, and the Arkansas Department of Finance and Administration typically only scores legislative bills based on their static costs, which means it is hard to say exactly how much of the effect we see in the charts above is due to dynamic behavior changing by individuals and businesses. And tax cuts rarely “pay for themselves,” in the sense of all of the revenue being made up by more economic activity, which would only happen at very high tax rates (a relationship sometimes called the Laffer Curve). But there is likely some positive, offsetting effect on tax revenues: they won’t decrease as much as the static analysis suggests.

In 2018, the Arkansas Tax Reform and Relief Legislative Task Force had some economists model the dynamic effects for reducing the personal and corporate tax rates to 6% (when they were both higher), and most estimates suggested $300 million of new economic activity from the personal income tax cuts and another almost $50 million from the corporate rate cut. This new activity should not be confused with new tax revenue, which will only be a fraction of the economic growth, but it does show there is some dynamic offset likely to have occurred as rates decreased (the analysis starts on page 15 of this report).

As the legislature looks to further reduce the burden of taxation in Arkansas, they should be able to comfortably lower rates by roughly the same magnitude as recent years without worrying about dramatically impacting the state budget.