by Joseph Johns

Arkansas recently reported the highest budget surplus in state history, a record-setting $1.628 billion as of June 30, 2022. While this is good news in some respects, the true history of state surpluses reveals a disturbing trend that needs to be addressed. Arkansas has run a surplus for 22 of the past 31 fiscal years. This means Arkansas taxpayers have been overpaying for government services 70 percent of the time for a generation. Dr. Jeremy Horpedahl, Director of the Arkansas Center for Research in Economics at UCA, recently discussed the budget surplus and possible pathways forward in an op-ed with the Arkansas Democrat Gazette.

As Horpedahl discusses, one option for the $1.6 billion surplus would be refunding the amount in some fashion to taxpayers, which comes out to $700 on average per adult in Arkansas. But this brings up a broader question: what if Arkansas had permanent budget rules to address how surplus tax revenue is spent? Even if the legislature does not elect to refund the $700 per adult this year, it is useful to think about improving Arkansas’s budget process for future years.

Arkansas has a strong budget framework already under the Revenue Stabilization Act (RSA). The law requires Arkansas to spend no more than it collects in a given year, essentially guaranteeing a balanced budget. However, the RSA is silent on how the state should spend any revenue brought in above annual forecasts. Arkansas is now facing this scenario, but in a bigger way than ever before. The state collected approximately $7,477.4 million in total revenue in fiscal year 2022, 2.1 percent above its own revenue forecasts. Horpedahl noted that Arkansas only allocated “$5.85 billion for all the necessary state spending in the general fund,” leaving Arkansas with the largest surplus it’s ever had.

For that matter, revenue collections were above forecast in every major tax category. Individual income tax collections were 0.9 percent above forecast, corporate income tax collections were 7 percent above forecast, and sales and use taxes came in 1.3 percent above forecast. All of this is indicative of the strong recovery Arkansas has made from the COVID-19 pandemic-induced economic decline and underscore the continuing importance and positive effects of the tax reform package passed last year.

Arkansas can and should continue to do even more by adopting tax and spending reforms of other more successful states. One common theme amongst more prosperous states is the presence of tax and spending limits which are built into these states’ constitutions. Tax Expenditure Limits, or TELs, as they are known, slow the growth of government spending and tax collection by different benchmarks, and many states already have these budget rules. Capping state spending by the rate of population growth and inflation is the most restrictive benchmark states use. Colorado uses this standard in its Taxpayer Bill of Rights, or TABOR. This makes intuitive sense since many government services such as education, transportation, and public utilities need to be bolstered when that state’s population increases. However, Missouri only allows its total tax collections to grow by a maximum of 1 percent of its prior year’s general revenue, or about $110 million in 2020.

TELs and similar budget rules can also require refunds be given back to taxpayers for any revenue collected above the TEL cap. Perhaps most crucial from a political perspective, highly effective TELs require taxpayer approval through a public vote “if legislators have a better idea than refunding all the money directly to taxpayers,” according to Horpedahl.

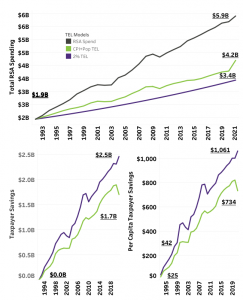

Figure I: 1992 – 2021 TEL Dashboard

To show the possible impact of different spending caps, ACRE researchers created several retrospective estimates of adopting two different budget rules at different points in the past. Although we cannot know exactly how the budget process would have worked out under these different rules, our examples provide evidence that the savings for Arkansas taxpayers would be large cumulatively, even though for any specific year only minimal reductions in spending would have been needed.

If we start the estimates in 1992, the same year that Colorado adopted its TABOR limit, total spending in the Arkansas General Fund would have grown from $1.9 billion in 1992 to about $4.2 billion in 2021 (shown by the green line in the chart to the left). Instead, spending actually grew to about $5.9 billion (the black line in the chart). The difference, around $1.7 billion, is what could have been saved under a rule similar to Colorado’s and would currently amount to about $700 per person in Arkansas.

This number should be taken as an “upper limit” of the savings under this rule, but shows the potential power of cumulative savings under a budget rule. Alternatively, a much stricter budget rule, such as limiting state spending growth to 2 percent each year, is shown by the purple line in the chart. Some states have rules which limit state spending growth to a specific percentage (such as Oklahoma), and others use a blend of the “inflation plus population” rule and a specific percentage (such as Ohio). Again, these estimates should be seen as illustrations of how such a budget rule would work, not as what would have actually happened if Arkansas had adopted a hypothetical TEL rule.

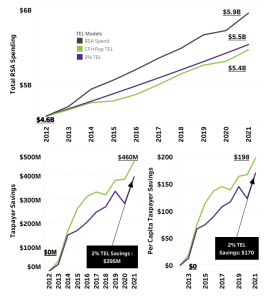

Figure II: 2012 – 2021 TEL Dashboard

However, looking back all the way to 1992 may not be the most useful timeframe for Arkansas. Major changes to the funding of local school districts came into place in the late 1990s and 2000s due to Arkansas Supreme Court ruling, as well as other important changes. Even looking at a shorter time period, such as from 2012 to 2021, the benefits of a spending cap would be noticeable to Arkansas taxpayers. The chart to the right shows a similar estimate of spending from 2012 to 2021 under different spending caps. Whether Arkansas had used the “inflation plus population” rule or a 2 percent spending growth rule, spending would have grown from $4.6 billion in 2012 to about $5.5 billion in 2021. That growth in spending would be around $400 million lower than the actual spending growth, saving around $200 per Arkansan.

Adopting such a reform in the special session called for the week of August 8 this year or in future budget sessions could pave the way to dramatically reduce the individual income tax and reduce the burden on business and higher income individuals and make Arkansas a more attractive place to live and work. The mandatory refund provisions of excess tax collections within the most effective TELs would also have the added bonus of greatly reducing the tax burden on low-income Arkansans.

Regardless of how the Arkansas General Assembly chooses to utilize the surplus, ACRE will continue to advocate for greater economic freedom for all Arkansans through creative and sustainable policy solutions.

To see more about how ACRE is working to inform the conversation around tax and spending issues visit the following links below:

- Arkansans Could See Big Savings from Special Session (from October 2021 session)

- Why Arkansas’s Long-Term Reserve Fund May Not Weather the Next Rainy Day (February 2020)

- Learning From Other States On Tax Reform (May 2018)

- There’s Nothing Natural about the State of Government Spending in Arkansas (2017 research paper)