This section, along with the other 11 chapters on the most important parts of the Arkansas economy, are authored by Jeremy Horpedahl, an ACRE scholar and assistant professor of economics at the University of Central Arkansas; Amy Fontinelle, author and editor of hundreds of public policy works; and Greg Kaza, Executive Director of the Arkansas Policy Foundation.

This section is a chapter in a larger work – The Citizen’s Guide to Understanding Arkansas Economic Data.

What is median household income in Arkansas?

The median household income is the number in the middle when we list the incomes of every household from poorest to richest. Think of this as separating households’ incomes into two equal groups: one group has incomes above the median, and the other has incomes below it. The median is exactly in the middle.

A household consists of one or more people who live together in a housing unit. The household may or may not be a family.

Suppose you have five households with different incomes:

Household 1: . . . . . . . . . . . . . . $10,000

Household 2: . . . . . . . . . . . . . . $30,000

Household 3: . . . . . . . . . . . . . . $50,000

Household 4: . . . . . . . . . . . . . .$100,000

Household 5: . . . . . . . . . . . . . .$200,000

The median income in this group is $50,000. Half the households have lower incomes, and half the households have higher incomes. The more common measure—the average, or mean—would be $78,000 in this example.

Why do government officials and economists use median household income as a measuring stick? While the measure isn’t perfect, unlike other measures (such as the mean), the median cannot be distorted by a small number of extremely rich (or extremely poor) households.

Why is median household income important to Arkansans?

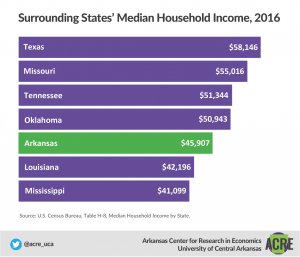

Arkansas’s median household income was $45,907 in 2016.1 That’s significantly lower than the median household income of most other US states—only West Virginia, Louisiana, and Mississippi are clearly lower (Kentucky is roughly equal). Arkansas’s median household income is the fifth lowest in the nation.

Arkansas was also far below the 2016 national median household income of $59,309 in 2016. The state came in at about 77.8% of the national level.

Your first thought might be that Arkansas’s low median household income means that Arkansans aren’t as well off as their neighbors or even most other Americans. But it’s more complicated than that.

What about cost of living?

That’s a great question. Median household income itself does not reflect differences in the cost of living. Before we can really know how much better off Texans are with their higher household incomes, we need to know how much it costs to live in Texas compared with how much it costs to live in Arkansas.

The US Bureau of Economic Analysis publishes a regional price parity index that can be used to adjust income data relative to other states. After making the adjustment, Arkansas’s median household income increases to $52,525, closer to the US median (about 89% of it), but still well below it. Texas’s income also goes up slightly, but its rank falls from 25th to 31st, as it has an average cost of living (though cost of living can vary considerably within a state).2

But Arkansas also remains near the bottom rank of states, rising from 47th to only 44th place. Meanwhile, Missouri, which was already ahead of Arkansas, jumps up 16 places, making it the 20th highest in the nation.

Nominal incomes (like the ones in the chart of surrounding states) can be deceptive when measuring a state’s relative standard of living. However, we should be cautious when interpreting the adjusted figures as well. A state may have a lower cost of living in part because it might be less attractive to live there. The lower prices of goods, and especially of housing, may reflect the relative lower demand to live in a particular area. But still, cost of living matters; median household income is only part of the story.

Are there types of income that aren’t counted in median household income?

Yes. Median household income presents an incomplete picture of the resources on which a household can draw. When it measures median household income, the Census Bureau counts most forms of income, such as wages, salaries, most investment income, most government benefits, child support, and alimony. A few forms of income, such as capital gains and lump sum payments, are not included.3 But most importantly, median household income does not in any way capture a household’s wealth. A household may be able to save extra in good years and draw on those savings in bad years to smooth out its income and maintain a consistent standard of living.

Does median household income consider the effect of taxes?

No, and the amount of household income that goes to taxes can vary dramatically depending on several factors:

• tax credits and deductions the household takes

• number of individuals contributing to household income

• number of children in the household

• marginal tax rates of each individual contributing to household income

Two households could have the same median income but different piles of money to work with after taxes.

What is the trend in Arkansas’s median household income?

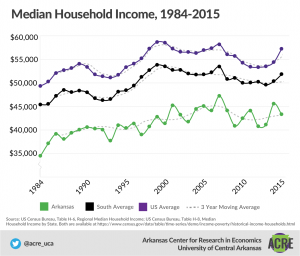

In 2016 dollars, median household income has trended upward overall from 1984 through 2016, though it was often flat or down for extended periods. Starting at $34,068, it hovered around $40,000 throughout most of the 1990s, peaked at $46,634 in 2007 just before the Great Recession began, and has ranged from about $40,000 to just under $46,000 over the last decade.4

While median household income has recovered since the bottom of the recession, it is still below the pre-recession peak, and in real terms it is just slightly above its 2001 level. Arkansas’s median household income has usually followed broad national trends, despite being well below the national average.5

Footnotes:

1 All figures in this subsection come from US Census Bureau, Table H-8, Median Household Income by State.

2 Authors’ calculations using the BEA’s 2015 Regional Price Parities by State data. Arkansas’s RPP is 87.4, meaning that the cost of living in Arkansas is 87.4% of the national average. The data can be found at https://www.bea.gov/ newsreleases/regional/rpp/2017/pdf/rpp0617.pdf.

3 US Census Bureau, “Income,” https://www.census.gov/glossary/#term_Income, accessed January 3, 2019.

4 US Census Bureau, Table H-8, Median Household Income by State.

5 Ibid.

There are 12 main chapters in the book, each detailing and explaining and important part of the Arkansas economy. They are Median Household Income; Fortune 500 Companies; Economic Freedom; Personal Income; Wages; Poverty; Migration; Education Attainment; Government Revenue and Spending; Total Nonfarm Payroll Employment; Gross Domestic Product; Unemployment and Labor Force Participation

These 12 chapters were written by expert authors, including: Jeremy Horpedahl, an ACRE scholar and assistant professor of economics at the University of Central Arkansas; Amy Fontinelle, author and editor of hundreds of public policy works; and Greg Kaza, Executive Director of the Arkansas Policy Foundation.

If you are interested in sharing your thoughts and questions about Arkansas’s economy, we would love to hear from you. You can email ACRE at acre@uca.edu, tweet Dr. Jeremy Horpedahl, at @jmhorp, or comment on ACRE’s Facebook page.

If you would like a printed copy for your own home or office, please email acre@uca.edu with the subject line Printed Citizen’s Guide, and include your name, your organization’s name, and your address.