By Jeremy Horpedahl, ACRE Director and UCA Associate Professor of Economics

Arkansans have seen multiple reductions to their taxes, especially income taxes, in recent years. Starting from a top income tax rate of 7 percent a decade ago, income tax rates have gradually been reduced. The top individual income tax rate has already been lowered to 4.4 percent, and there have been other changes made to reduce income taxes for lower-income Arkansans (who don’t pay that top rate) as well.

What has been the effect of all those changes? And what are the next steps for tax reform in Arkansas?

In our latest publication The Future of Arkansas Tax Reform: Next Steps on the Road Map to Competitiveness, we have once again teamed up with experts at the Tax Foundation to look at those questions in detail. Our 2016 book with the Tax Foundation comprehensively overviewed the tax system in Arkansas seven years ago. Much has changed since then.

- has the latest tax information since 2016,

- focuses on ways that the income tax burden in Arkansas could be reduced, both for individuals and businesses, and,

- provides suggestions for new reforms – since many of those we suggested in 2016 have now been enacted.

There has been a lot of conversation over the past few years about eliminating the income tax in Arkansas, but no one has laid out a path to achieving this goal. In our book, we show what it would take and how long it would be before the income tax could be eliminated. It could take as long as 27 years under a conservative approach, but it could also be done as quickly as 8 years under an aggressive approach with some budget cuts.

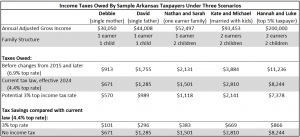

In addition to eliminating the income tax, our book suggests several other intermediate and other tax reforms that would benefit Arkansas taxpayers, including a reduction of the top personal income tax rate to 3 percent (from the current 4.4 percent). The table below shows the effect of that change on several sample taxpayers. The income levels of the first four sample taxpayers represent the median family income in Arkansas for different family structures, with the fifth sample taxpayer roughly representing a taxpayer at the 95th percentile (just inside the top 5 percent).

Notes: calculations assume that taxpayers are taking the standard deduction, and that two-earner families have income evenly split between earners. Does not include the one-time $150 credit in 2024.

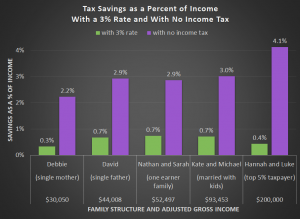

The table shows taxes owed under three scenarios. The first scenario assumes that there were no changes made in 2015 or any year afterwards – this is the highest tax burden in the table and is provided for historical context on the importance of recent tax reductions. The second scenario is current tax law, as it will apply in 2024 (and future years if no further changes are made). The final scenario shows tax burdens under a hypothetical 3 percent top income tax rate in Arkansas. Finally, the table shows the savings compared to current tax law under a 3 percent top rate, or if the income tax is eliminated. The results are also presented in the figure below, showing the potential tax reductions as a percent of income for these same five families.

In addition to these potential individual income tax rate reductions, our book discusses several changes to the corporate income tax. The first change is also about tax rates and involves reducing the corporate income tax rate in tandem with personal income tax rate reductions, as the legislature has done with most recent tax reductions. But the other changes are structural in nature, changing how the corporate income tax works in Arkansas, as well as other business taxes.

The recommended changes for business taxes include:

- Permanent expensing of capital investment

- Repealing the state franchise tax, which taxes the net worth of businesses

- Eliminating the business inventory tax

- Expanding net operating loss provisions, so that businesses are taxed over the business cycle rather than for individual years

Each of these changes individually would improve Arkansas’s competitive environment for business growth and attracting new firms. Improving competitiveness is important because currently Arkansas currently ranks 40th in the Tax Foundation State Business Tax Climate Index, trailing all of our neighboring states and having the second lowest rank in the South (only Alabama is slightly lower).

There are many paths that Arkansas could take to move forward with future tax reforms. Our latest book provides a menu of options for policymakers to consider when making further reductions in the tax burden imposed on individuals and businesses.