By Joseph Johns, ACRE Policy Analyst

Arkansas has reduced its state income tax in recent years. However, Arkansans still face considerable tax burdens at the local level. Taxpayers face multiple local tax burdens that chip into their earnings and reduce the overall well-being of Arkansas’s citizens. Currently, there are two bills before the Arkansas legislature that could limit these harmful local taxes which will be discussed in more depth below.

Local Income Taxes

While most US states, including Arkansas, have statewide income taxes, in a few states there are income taxes imposed at the local level. According to the Tax Foundation, as of 2022, “Seventeen states have county- or city-level income taxes.” Arkansas is fortunately not on that list. However, the unintended consequences of local income taxes are still important to consider and guard against to protect taxpayers’ financial stability during these potentially turbulent times. Representative David Ray [R-Maumelle] filed HB 1026 which bans cities, counties, and other local governments in Arkansas from imposing an individual income tax.

Policymakers realize that the Arkansas income tax code needs to remain competitive with other states and have taken steps in the past several legislative sessions to address the problems associated with the Arkansas income tax. The Arkansas General Assembly reduced the top personal income tax rate from the highest in state history in 2015, seven percent, to the lowest it’s ever been in state history in 2022, 4.9 percent.

Restricting counties and municipalities from assessing an income tax would be beneficial for multiple reasons. The first and most important is that it keeps more money in the hands of hard-working taxpayers. Indiana, one of the 17 states which assessed county income taxes in FY 2021, collected $3.49 billion in real 2022 dollars from county individual income tax receipts. This is equivalent to $513 per capita in real 2022 dollars. County income taxes are imposed in every county in Indiana, and the median local option income tax rate was 1.75 percent in FY 2021. If Arkansas had adopted the same median rate, the per capita local income tax amount in Arkansas could be around $340 (a rough estimate using IRS taxable income in Arkansas). The Indiana rate is also roughly the median of the current county local option sales tax which reaches as high as 3.125 percent (before including city sales taxes).

Local Option Sales Taxes

While the Natural State does not currently have any counties that impose a local option income tax, Arkansas does have a large number of local sales taxes, which have been rising the past few decades primarily due to local option sales tax elections held at special elections. HB1368, which was filed in the 93rd General Assembly in 2021, would have limited when special elections could be held to overlap with general or primary election dates, but did not pass (some restrictions on election dates were imposed by a separate 2021 bill, SB 496).

Seventy-four out of 75 Arkansas counties assess a local option sales tax as of 2023, as well as over 300 cities (Monroe County has no sales tax, but 4 cities in the county do, with 3 cities taxing at 3 percent). As a result, Arkansans currently pay the third highest combined average state and local sales tax rate in the nation at 9.47 percent as of July 2022. According to the Tax Foundation, Arkansas has a 6.5 percent statewide sales tax, while local sales tax rates can be as high as 6.125 percent, with an average of about 3 percent.

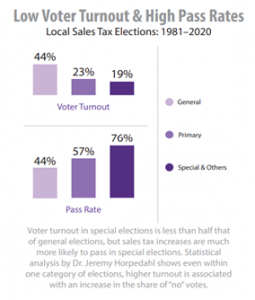

Dr. Jeremy Horpedahl, Director of ACRE and Associate Professor of Economics at the University of Central Arkansas, studied the effects of local option sales tax elections to determine how much this seemingly benign policy had on Arkansas taxpayers. He found that 82.2 percent of the 1,004 local option sales tax elections were held during special elections. This is important due to the low turnout rate for special elections. The figure below shows the inverse relationship between turnout rates and the success of a local option sales tax election.

Figure I: LOST Election Voter Turnout Passage Rates

The most significant lesson from the chart above is that as voter turnout for local elections increases, the passage rate of local taxes decreases. Therefore, if Arkansas wants to limit the further increase of local sales taxes, they could require such elections be held during special or general election dates.

There are also additional costs to holding special local option income tax elections. Horpedahl estimated that local option sales tax elections cost taxpayers a cumulative $10 million (in inflation-adjusted dollars), or over $250,000 per year from 1981 to 2020. $10 million is the cost of holding the elections themselves, and not the added tax burden that would result from the successful passage of a local income or sales tax election. This is not just the “cost of democracy” but rather an unnecessary burden that Arkansas counties have placed on their residents since they could be held alongside general or primary elections at no additional monetary cost.

A&P Taxes

Advertisement and Promotion, or A&P taxes, are assessed on the sales of prepared food and/or short-term lodging accommodations in Arkansas. The tax is often colloquially referred to as the “hamburger tax” or “hotel tax.” It affects local business owners and increases the cost to consumers of many everyday needs. If you have ever stayed in a hotel in Bentonville or Little Rock, or eaten out in one of the 57 cities or towns with A&P taxes in Arkansas, then you have felt the cost of this often-overlooked tax. The tax is imposed on top of the general sales tax discussed in the previous section, meaning the combined tax rate can be well over 10 percent in many cities.

Enforcement of these taxes is oftentimes ambiguous and difficult to manage. The state of Arkansas has a precise definition of “prepared food” can make it difficult for grocery stores to differentiate between “prepared food” and everything else. For instance, when the seller heats or mixes any food and sells it to the customer, that food is considered prepared. It gets worse. Deli meats and cheeses also get a carve out (pun intended) since “food that is only cut, repackaged, or pasteurized by the seller” is not considered prepared food. This implies that such foods are not included in the gross receipts tax assessed under the A&P tax definition.

The proceeds of A&P taxes are used for the purpose of advertising and promoting the city raising the tax. The logic for imposing the tax on businesses such as restaurants and motels is that they are the industries that would primarily benefit from increased visitors to an area. However, the added burden of A&P taxes could also make it more difficult for lodging and dining establishments to compete with localities without these burdens. Each A&P tax is approved by an unelected advertisement and promotion commission. A&P commissions are composed of seven members, including at least three owners of hotels or restaurants. Each A&P Commission has the power to unilaterally impose local option sales tax rates of up to 3 percent (and an additional 1 percent in some cities) without consulting the voters. Representative David Ray [R-Maumelle] filed HB 1027 to require voter approval of A&P taxes before a city or county can assess such a tax.

The A&P tax is also imposed despite record high levels of food inflation. Prices at restaurants soared 9.1 percent in 2022 in the West South Central U.S. Census Region (which includes Arkansas), according to the U.S. Bureau of Labor Statistics (data from BLS series CUUR0370SEFV). Requiring voter approval for A&P taxes would help reduce the share of cities with A&P taxes since past research by Dr. Horpedahl has found an inverse relationship between turnout rates and other local sales tax elections.

There has also been some examples of waste and abuse of A&P tax funds in Arkansas. The Searcy A&P Commission was accused by a local attorney of holding A&P funds hostage to pay for wasteful sports infrastructure projects in 2021. Conway paid $130,000 for a non-functional Christmas tree with A&P tax revenue in 2013. Moreover, many cities seem to have moved beyond the letter of the law in using the funds, which limits the funds for use in advertising and promoting the city, constructing and operating a convention center, and operating a tourist promotion facility (in certain cities, an additional 1 percent tax can be used for city parks and recreation).

Enhancing taxpayer protections from local taxes can improve the quality of life for Arkansans and their communities. Requiring all local tax elections to be included during general and primary elections can help reduce the burden of local tax rates and prevent counties from working against the wishes of the General Assembly to reduce tax burdens for all Arkansas residents.