By Caleb Taylor

Arkansas’s small businesses are still feeling the effects of the economic downturn from COVID-19, ACRE Director and UCA Associate Professor of Economics Dr. David Mitchell said in a speech to about 25 Conway Kiwanis Club members at Larry’s Pizza on Wednesday, Nov. 4.

Mitchell said the Natural State could be better prepared for future recessions by improving Arkansas’s tax structure, lowering or removing some occupational licenses and funding and reforming Arkansas’s Long Term Reserve Fund.

Small Business Woes

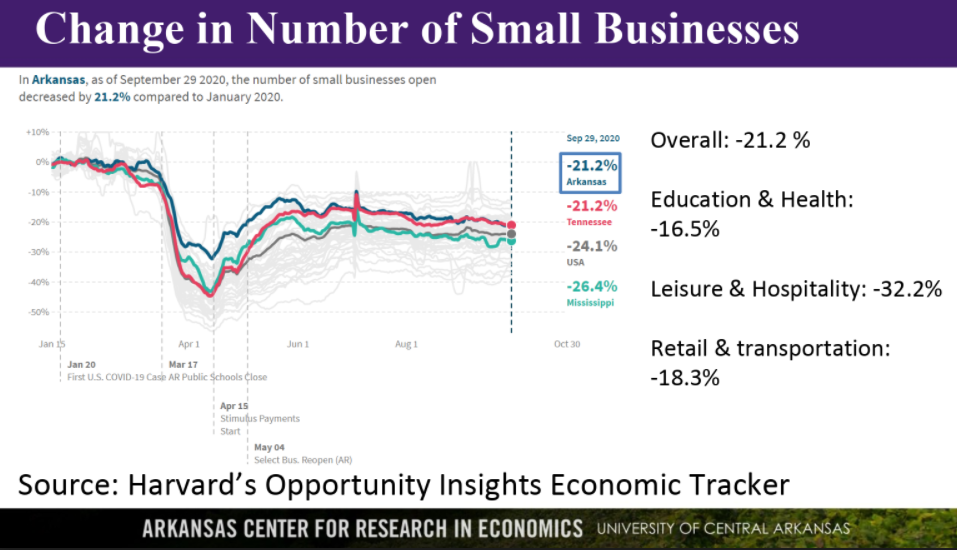

The number of small businesses open in Arkansas has decreased by 21.2 percent as of September 29 compared to January 2020, according to Harvard University’s Opportunity Insights Economic Tracker.

That’s better than the national average of 24.1 percent but still nothing to celebrate, according to Mitchell.

Mitchell said:

Small businesses are struggling. They don’t have access to capital markets like other (larger) businesses. For small businesses, it’s been really hard as you might guess. Everyone of these numbers has a story behind them. That’s someone whose business has closed. Arkansas is one of the states that didn’t do a full close down. I think it helped a lot but it’s still pretty brutal.”

State Tax Revenue

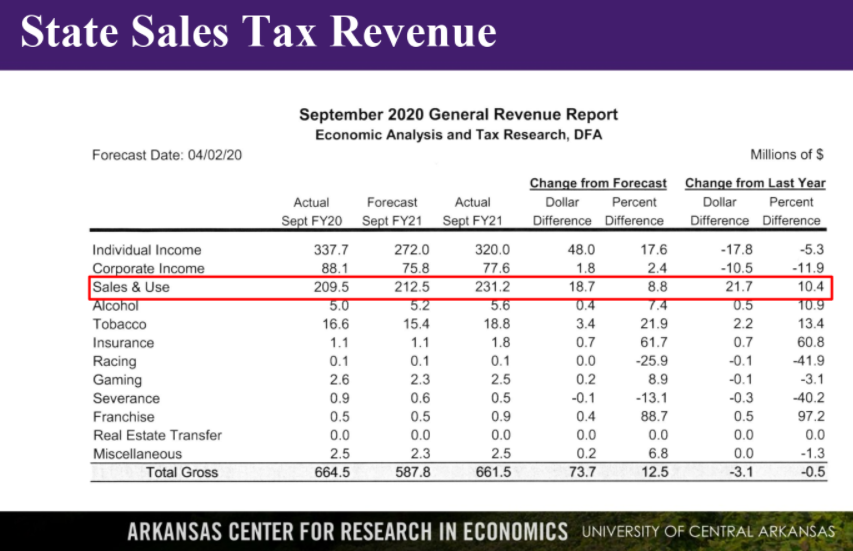

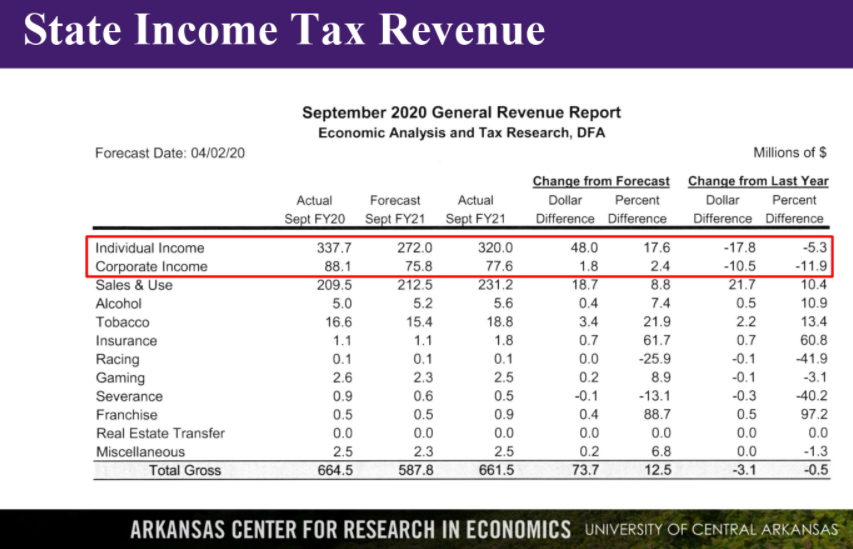

State taxes to fund government services has been a mixed bag so far in 2020, according to Mitchell.

Sales taxes are above projections while individual and corporate income taxes are less than projected so far.

Mitchell said:

Sales tax revenue has actually been up. Sales tax revenue tends to be smoother than other types of revenue. It’s one reason why economists have a tendency to suggest that you depend more on sales taxes than some of the other taxes. It’s just smoother…it doesn’t go up and down like other types of revenue. Individual income and corporate income tax [revenue] has fallen. Corporate income [tax revenue] is just very, very volatile. When the economy is good, corporate income [tax revenue] skyrockets and then plummets when it’s bad. Individual income tax [revenue] is a little more stable, but it’s not as stable as sales taxes. Arkansas relies a lot on income taxes for revenues. That makes it very vulnerable during recessions. We should pick a smoother stream of revenue such as sales taxes.”

Possible Reforms

Mitchell concluded by recommending Arkansas policymakers reform the state’s occupational licensing burden.

Mitchell said:

Arkansas is a state that has a lot of regulations. We have a lot of occupational licensing for low to moderate wage jobs. Some might think that these are put into place to protect people, but sometimes these are just barriers to entry.”

For an example of a possible solution, check out ACRE Policy Analyst Alex Kanode and ACRE Scholar and UCA Associate Professor of Economics Dr. Thomas Snyder’s op-ed “Show-Me the way” (published in the Arkansas Democrat-Gazette on October 22) about a recent occupational licensing reform bill passed by the Missouri legislature, known as universal licensure recognition.

Mitchell also recommended Arkansas legislators consider enacting stricter deposit and withdrawal rules from the state’s Long-Term Reserve Fund, a kind of state savings account for rainy days, so the state will be better prepared for future recessions.

For more on Arkansas’s Long-Term Reserve Fund, check out Mitchell’s blog post entitled “Why Arkansas’s Long-Term Reserve Fund May Not Weather the Next Rainy Day.”

Mitchell and Stansel’s paper entitled “State Fiscal Crises: Are Rapid Spending Increases to Blame?” published in the Cato Journal analyzes how government spending increases during economic expansions worsen state fiscal crises.