By Caleb Taylor

In an op-ed published in the Arkansas Democrat-Gazette on February 15 entitled “State status check,” ACRE Scholar and UCA Assistant Professor of Economics Dr. Jeremy Horpedahl and National Taxpayer Union Foundation Economist Nicole Kaeding say Arkansas’s sales taxes have generally increased, income taxes have decreased, and property taxes have generally stayed the same over the past decade.

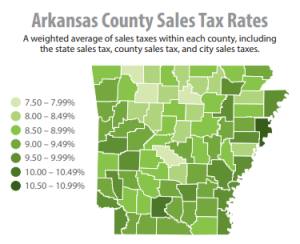

Arkansas Sales Taxes

Horpedahl and Kaeding on sales taxes:

The statewide sales tax stood at 6 percent in 2010, but it is now 6.5 percent after voters approved a temporary increase dedicated to highway funding in 2012. Cities and counties in Arkansas can also add their own sales taxes on top of the statewide rate. A decade ago these local sales taxes averaged about 2 percent across the state, while today they are closer to 3 percent. That means the combined rate that Arkansans paid, on average, has increased from 8 percent to almost 9.5 percent. That’s the third-highest rate in the nation, just slightly behind Tennessee and Louisiana. Arkansas voters are being asked again to approve a permanent extension of that sales tax this fall. If voters approve the 0.5 percent tax for highways, and more local sales taxes increase (such as the proposed 1 percent tax in Little Rock), Arkansas could fight for the dishonor of the highest sales tax in the nation.”

One exception to this sales tax trend is the state sales tax rate on groceries which decreased from 2 percent a decade ago to ⅛ percent today, according to Horpedahl and Kaeding.

Arkansas Income Taxes

Horpedahl and Kaeding on income taxes:

Most visibly, the state’s top personal income-tax rate was 7 percent in 2010. This year it is being cut to 6.6 percent, and it will drop again next year to 5.9 percent. That’s a big improvement, along with the reduction in the corporate income-tax rate, which is being cut from 6.5 to 5.9 percent. But it’s not just high-income earners that have had their income taxes cut, as the top rate cut was the third step in Gov. Asa Hutchinson’s plan to reduce income-tax rates across the board. Two previous tax cuts directly benefited middle- and low-income taxpayers. While Arkansas’ three sets of tax brackets are complex, all taxpayers are now paying less in taxes, boosting their after-tax income. We estimate that low-income taxpayers are saving between $100 and $200 per year, while the middle class is saving between $300 and $400 per year. That’s a few meals out, a car repair more easily covered, or a surprise for the kids.”

Horpedahl and Kaeding say further income tax rate decreases to Gov. Asa Hutchinson’s eventual goal of 5 percent is “feasible” and would be a “welcome improvement.”

Arkansas Property Taxes

Horpedahl and Kaeding on property taxes:

Not too much has changed here. While some tax rates may have increased, on average these have been in line with increases in home value: Average tax rates for owner-occupied homes were about 0.6 percent in both 2010 and in the latest available data, but the homestead tax credit was increased by $25, which will lower property-tax bills slightly in future years.”

You can read the entire op-ed here.

For more of ACRE’s work on taxes, check out the below links:

Arkansas Democrat-Gazette Op-Ed “Talk about taxes”

The Road Map to Tax Reform in Arkansas

Lessons From Other States Tax Reform Attempts

More on State Taxes and Spending