By Jeremy Horpedahl and Nicole Kaeding

[Cross posted at the Tax Foundation Blog]

January 31, 2019

Yesterday, Governor Hutchinson and legislative leaders in Arkansas announced their final plan for restructuring Arkansas’s individual income tax brackets. After more than 18 months of study, the Arkansas General Assembly will consider the plan starting next week. The plan would lower tax liabilities for a number of filers in Arkansas and implements the third phase of tax cuts in the Natural State.

The plan introduced today differs from previous versions discussed in the Tax Reform and Relief Legislative Task Force. Several weeks ago, it was reported that the previous version of the “2/4/5.9% plan,” as it was known, contained a miscalculation, which would have increased taxes for approximately 200,000 Arkansans.

This new plan targets the tax relief onto higher-income Arkansans, defined as those with taxable incomes above $79,300. Arkansas currently uses three rate schedules for individuals, based on their income. This plan would simplify the third rate schedule, reducing state revenues by $97 million over the next several years.

Starting on January 1, 2020, the plan would simplify the brackets for those above $79,300 in income from six to three, with the top rate falling from 6.9 percent to 6.6 percent. Then, on January 1, 2021, the top rate would be cut again from 6.6 percent to 5.9 percent. At the same time, the top rate on the middle rate schedule, for those between $22,200 and $79,300 in income, would drop from 6 percent to 5.9 percent, to match the top table.

| Total Income Under $22,000 | Total Income Between $22,200 and $79,300 | Total Income Above $79,300 | |||||

|---|---|---|---|---|---|---|---|

| $0-$4,499 | 0% | $0-$4,499 | 0.75% | $0-$4,499 | 0.90% | ||

| $4,500-$8,899 | 2% | $4,500-$8,899 | 2.50% | $4,500-$8,899 | 2.50% | ||

| $8,900-$13,399 | 3% | $8,900-$13,399 | 3.50% | $8,900-$13,399 | 3.50% | ||

| $13,400-$22,199 | 3.40% | $13,400-$22,199 | 4.50% | $13,400-$22,199 | 4.50% | ||

| $22,200-$37,199 | 5% | $22,200-$37,199 | 6.00% | ||||

| $37,200-$79,300 | 6% | $37,200+ | 6.90% | ||||

| Total Income Under $22,000 | Total Income Between $22,200 and $79,300 | Total Income Above $79,300 | |||||

|---|---|---|---|---|---|---|---|

| $0-$4,499 | 0% | $0-$4,499 | 0.75% | $0-$4,000 | 2.00% | ||

| $4,500-$8,899 | 2% | $4,500-$8,899 | 2.50% | $4,000-$8,000 | 4.00% | ||

| $8,900-$13,399 | 3% | $8,900-$13,399 | 3.50% | $8,000+ | 5.90% | ||

| $13,400-$22,199 | 3.40% | $13,400-$22,199 | 4.50% | ||||

| $22,200-$37,199 | 5% | ||||||

| $37,200-$79,300 | 5.9% | ||||||

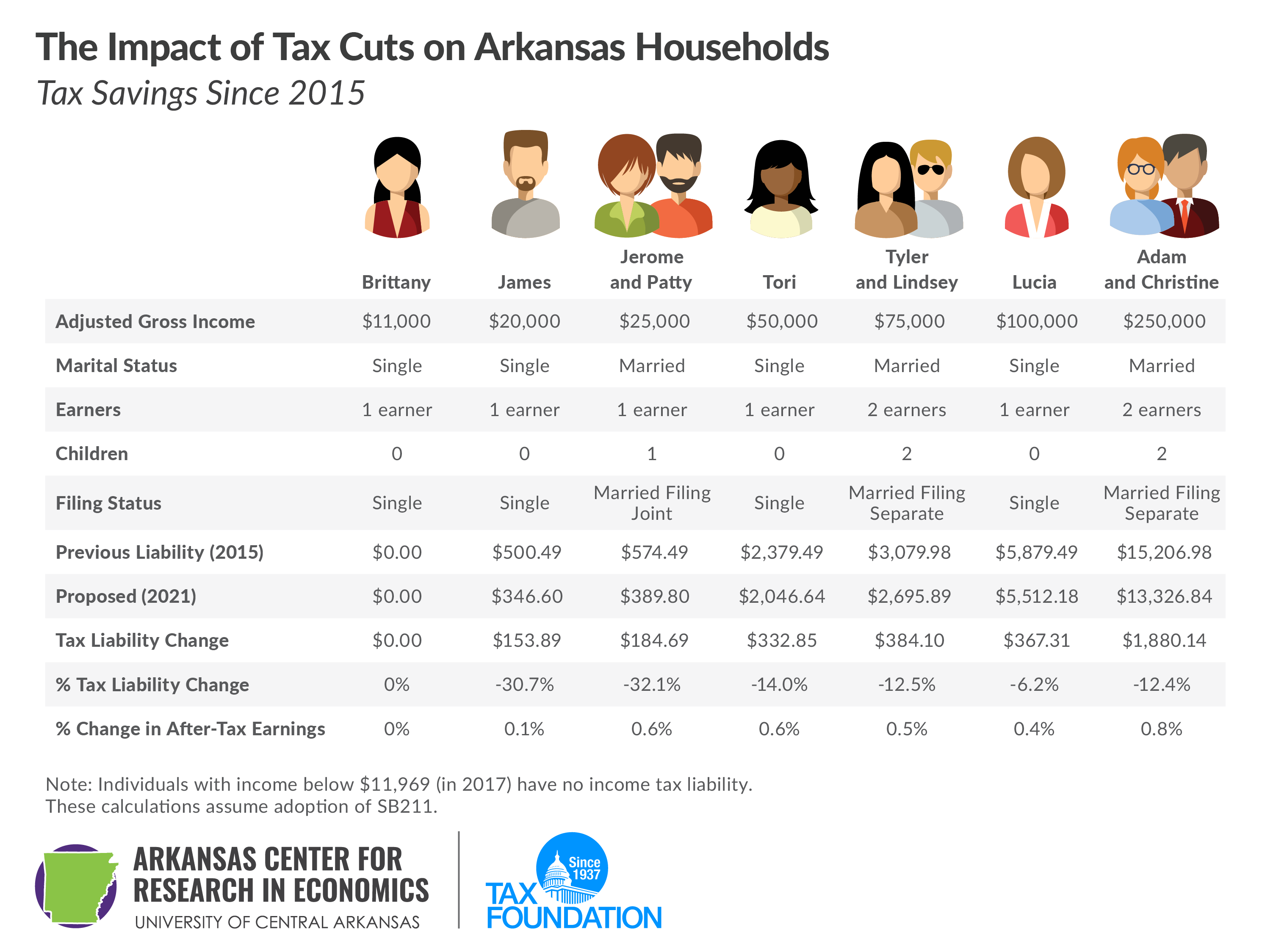

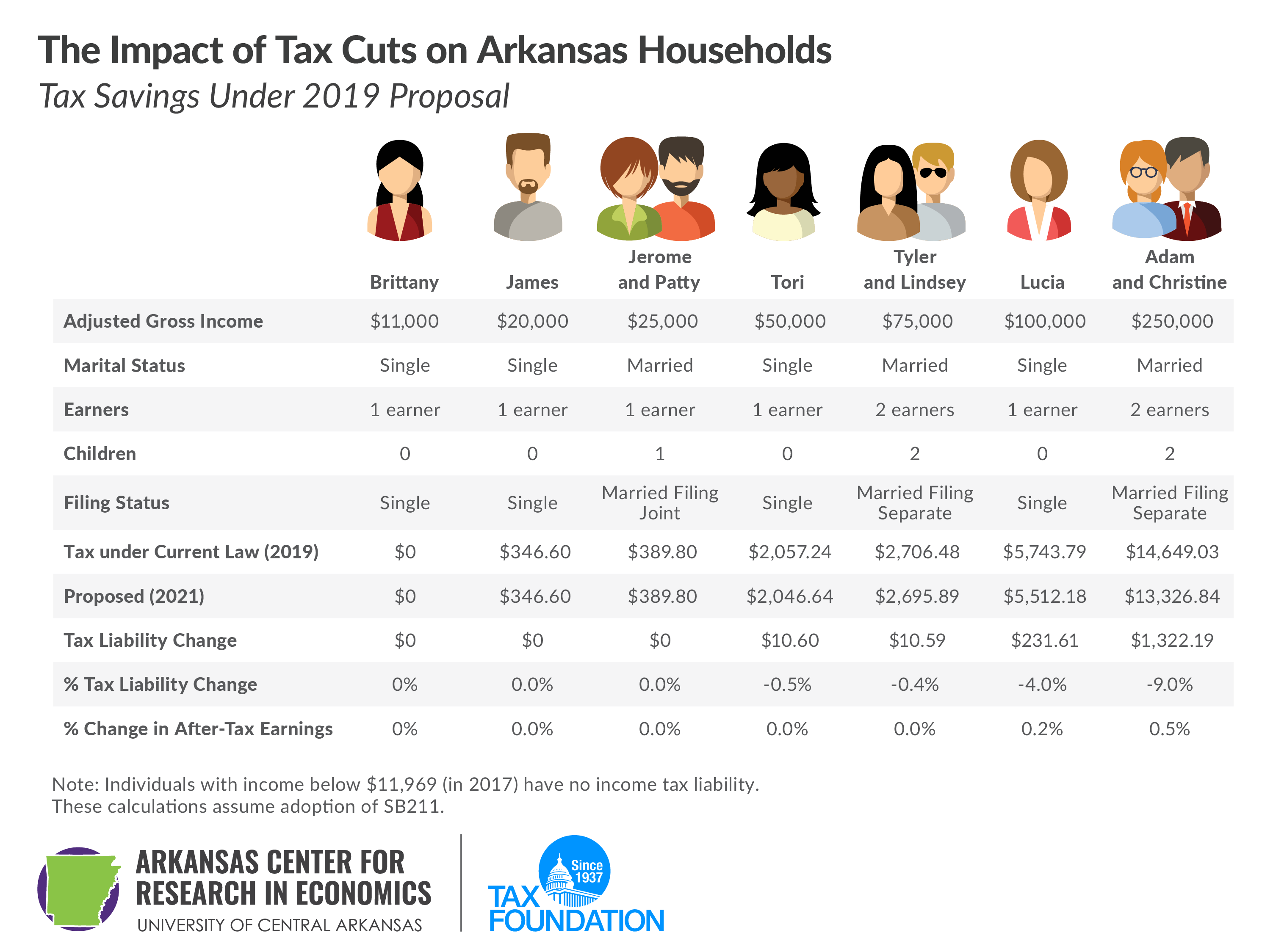

We have estimated the impact of these tax cuts on seven sample taxpayers in Arkansas. As shown below, taxes would be lowered for those with income above $37,200. Those below that income level do not see any tax cuts under this plan.

However, these cuts are the third phase of the individual income tax cuts in Arkansas. Looking only at the 2019 proposal misses much of the work done by the General Assembly in previous sessions. First, in 2015, it passed tax cuts for individuals with incomes between $21,000 and $75,000. Second, in 2017, it passed tax cuts for individuals with incomes below $21,000. (Single individuals with income below $11,969 have no income tax liability due to Arkansas’s low-income tax credit first adopted in 1991 and expanded in 2007.) So, this final plan brings those with incomes above $75,000 closer to the cuts already passed in 2015 and 2017. (These numbers vary slightly due to Arkansas’s policy of inflation-adjusting their tax brackets annually.)

Here, we see that the income tax cuts are spread throughout the income spectrum. James has seen his income tax cut by 30.7 percent since 2015, compared to a 14 percent reduction for Tori and a 6.2 percent reduction for Lucia. Adam and Christine receive the largest nominal tax cut, $1,880.14, but as a percent of their income, their cut is among the smallest.

The $97 million revenue cost is also similar to that of the 2015 tax cut targeted at middle-income taxpayers.

And the reduction of the top rate from 6.9 percent to 5.9 percent makes Arkansas more competitive among its neighbors and in the South generally. Currently, the 6.9 percent rate is the highest among Arkansas’s neighboring states, and the second highest in the South (just below South Carolina’s 7.0 percent). This reduction brings Arkansas roughly in line with neighboring Missouri (5.9 percent) and Louisiana (6.0 percent), as well as Georgia and Kentucky (both at 6.0 percent). Neighboring Oklahoma and Mississippi are still slightly lower at 5.0 percent, and Texas and Tennessee have no income tax on wages and salaries, so there is still work to be done in the future. Ideally, future legislatures will work to further simplify the rate schedules, but this is a big step in the right direction.

Finally, these examples do not include other expected tax changes in Arkansas this legislative session. This bill is the first in a series of reforms planned by the General Assembly. The legislature is expected to consider reforms to its corporate income tax rate and tax base and changes to the state’s sales tax following the U.S. Supreme Court’s Wayfair decision, among other changes.

Calculation Assumptions

For our calculations, we used the Arkansas tax system as it exists on both January 1, 2015 and January 1, 2019. For the 2019 calculations, these are after the scheduled phase-in of the low-income tax changes effective on January 1. We assumed all filers used the standard deduction, for simplicity and comparisons (those though with itemized deductions will not see an increase, unlike previous versions of the plan). These calculations assume the rate structure under the “2/4/5.9% plan” when it’s fully phased in in 2021.

These calculations do not include any other tax changes, such as taxing online transactions under a sales tax, other sales tax base changes, or any business-side changes.

Jeremy Horpedahl is an ACRE Scholar and a UCA assistant professor of economics. Nicole Kaeding is a director of special projects at the Tax Foundation.

Jeremy Horpedahl is an ACRE Scholar and a UCA assistant professor of economics. Nicole Kaeding is a director of special projects at the Tax Foundation.