By Caleb Taylor

What are the trade-offs states make when offering economic development incentives to private businesses?

Prof. Nathan Jensen discussed this and more on Tuesday, November 13th in the UCA College of Business auditorium to a crowd of over 70 attendees.

Jensen is a Professor in the Department of Government at the University of Texas-Austin. He teaches courses and conducts research on government economic development strategies and business-government relations, among other things. He is a coauthor of the book Incentives to Pander: How Politicians Use Corporate Welfare for Political Gain with Edmund J. Malesky of Duke University. The book focuses on political incentives for economic subsidies.

Jensen explained that voters tend to give politicians credit for luring businesses through these incentive programs although they can be “expensive, distorting and ineffective.”

However, voter approval for these programs declines once they’re shown some of the tradeoffs.

For example, support for using property tax exemptions decreases when people are also asked to consider that this would lower tax revenues that support schools.

Jensen said:

Voters love the use of incentives to bring jobs until you show them the costs. I don’t mean the dollar costs. I mean…what are the tradeoffs?”

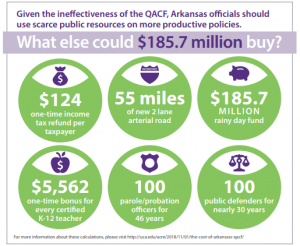

Speaking of tradeoffs, here’s some of the alternative programs Arkansas could fund with the money it’s appropriated to Arkansas’s “Quick Action Closing” economic development incentive fund since 2007:

Jensen concluded his remarks with noting that such incentives rarely change firms’ behavior even though all states engage in such policy.

Jensen said:

Just because another state does something that’s stupid, it doesn’t mean you should too. There are unique things about Arkansas and there’s reasons why firms want to be here. There are reasons why firms want to be elsewhere. You just have to know that very rarely these incentives change firms’ investments.”

You can watch a video presentation summarizing Jensen’s research here. A video recording of Jensen’s talk will be uploaded to the ACRE Youtube page soon.

New Policy Review

Jensen’s visit wasn’t the only big news related to incentives on Tuesday. The Arkansas Center for Research in Economics released a new policy review entitled Government Accountability: 5 Fixes for Arkansas’s Quick Action Closing Fund by ACRE Policy Analyst Jacob Bundrick last week.

The review outlines five ways Arkansans can improve the transparency and accountability of the program.

The five reforms include:

- Improving reporting standards of the state’s use of the QACF

- Making clawback agreement formulas public and void of renegotiation

- Limiting the value of subsidies awarded on a per-job basis

- Paying subsidies awarded as project targets are achieved

- Capping the number of QACF projects allowed in any given year

For a one-page summary of Bundrick’s research on the QACF, go here. The full text of the policy review can be found here.

For more of ACRE’s research on targeted incentives, go here.