Arkansas’s state government is once again facing a large budget surplus, and once again the legislature is planning to use this surplus as a down payment on further reductions in income and other taxes. A special legislative session begins this week, and several proposed bills will reduce personal income taxes by 0.5 percentage points, corporate income taxes by the same amount, and increase the homestead property tax credit by $75 per year.

What will be the effect of these proposed tax cuts? The Arkansas Department of Finance and Administration estimates that the income tax cuts will cost the state budget about $322.3 million on an annual basis ($483.5 million in the first year, because the calendar and fiscal years don’t line up and this is retroactive for all of 2024). Property tax cuts will cost about $50 million per year (this doesn’t come out of the state budget, but instead is funded out of a special 0.5% sales tax).

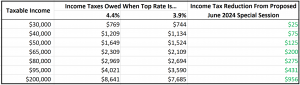

But what will the effect be for Arkansas taxpayers? The $75 property tax credit is straightforward: every primary residence in Arkansas will get the same benefit. For the personal income tax cuts, the savings received will depend on your level of income, but any Arkansas taxpayer with taxable income over $25,000 will receive some benefit. The table below shows several sample taxpayers and the benefit they will receive from the proposed reduction of the top marginal tax rate from 4.4% to 3.9% (note: income figures are for taxable income, which is after subtracting the standard deduction or other tax deductions, and they also include one personal credit):

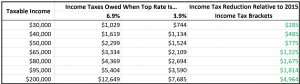

It is also worth considering that the current proposed income tax cuts are the next step in a long series of tax reductions in Arkansas that began in 2015. The cumulative effects of these tax cuts, including the current proposal, result in very large tax reductions for middle-class households. Keep in mind also that dual-income families are taxed separately, so the benefit could be twice as large as the following table shows. This table compares the tax system in Arkansas before the first cuts in 2015 (when the top rate was 6.9% and many other features were different) were enacted with the proposal currently before the legislature to reduce the top rate to 3.9%:

For more information on the history of tax reform in Arkansas and ideas for future reforms, see our 2023 book The Future of Arkansas Tax Reform jointly published with the Tax Foundation.