As the legislative session continues, one major topic that has still not been addressed is tax reform. While the personal income tax will likely get some attention this year, changes to corporate taxation are just as important and several bills may be considered. Despite the progress made in reducing the state’s corporate income tax from 6.5 percent in 2015 to 5.3 percent in 2023, the Natural State could still make improvements to its corporate income tax code. Currently, three bills that would help make Arkansas a more attractive place to do business: HB1239, HB1045, and HB1044 are waiting to be heard in Committee.

HB1239 repeals the $150 to $400 franchise tax paid by “all corporations, LLC’s, banks, and insurance companies registered in Arkansas.” HB1045 repeals the state’s throwback rule, which results in some corporations paying more sales tax than necessary as a result of interstate apportionment overlaps. Finally, HB1044 allows certain corporations to continue to receive income tax deductions for certain property. Since corporate taxation is even more complex than the individual income taxation, I will also give some background on relevant aspects of the corporate tax code.

Repealing the throwback rule and franchise tax were two important reforms of corporate taxation recommended by ACRE Director Jeremy Horpedahl in the 2016 publication he co-authored with the Tax Foundation, Arkansas: The Road Map to Tax Reform. Modifying business deductions has become more important since federal tax changes in 2017, so that Arkansas aligns with federal tax law.

HB1239: Repeals Arkansas Franchise Tax

HB1239 repeals the Arkansas corporate franchise tax, a tax on the capital stock of businesses. As of January 1, 2022, only 16 states had capital stock taxes on their books. Arkansas had the highest franchise tax rate of any state in the nation, at 0.3 percent of a business’s net worth with an unlimited collection cap. Arkansas requires corporations and banks with stock as well as mortgage loan corporations to send the state 0.3 percent of the firm’s outstanding capital stock. This acts as a wealth tax, a poor revenue-raising tool, and a harmful tax on the accumulated wealth of corporations. Arkansas’s tax rate is the highest in the nation, and there is no cap on the amount a business can pay (about half the states with a capital stock tax have a limit).

Accumulated wealth is what allows corporations to invest in their communities, hire new workers, and make any improvements necessary to their businesses to guard against future economic downturns. These investments are ultimately beneficial to workers who would otherwise suffer from layoffs and lower pay during turbulent economic times. The corporate franchise tax reduces the total amount of funds available to corporations to reinvest in their communities, workers, and business models, potentially weakening Arkansas businesses. This is opposed to the prevailing sentiment that businesses are power hungry, greedy, and are indifferent toward the people they serve. Rather, businesses in Arkansas are compelled by the state of Arkansas to pay the highest fraction of their total net worth every year, relative to all other states in the nation.

According to Janelle Fritts at the Tax Foundation, multiple states have been walking back their franchise taxes in an effort to attract and promote business formation and in-migration. “Kansas completely phased out its capital stock tax prior to tax year 2011, followed by Virginia and Rhode Island in 2015 and Pennsylvania in 2016. Mississippi is in the process of phasing out its capital stock tax, which should be completely eliminated by 2028. Connecticut is also phasing out this tax, completing the process by 2024.”

Despite the $34.1 million price tag associated with HB1239, the Arkansas legislature should consider passing the bill to encourage more small businesses to locate in Arkansas and reduce the cost of doing businesses in the Natural State.

HB1045: Repeals Arkansas’s Throwback Rule

Currently, Arkansas is one of 22 states with what is known as a “throwback rule” which taxes income from sales that are not taxed in other states.

When a corporation meets certain benchmarks primarily related to the revenue and sales in a particular state, the corporation establishes an economic nexus in that state, which makes all of its sales taxable under that state’s law. States started imposing throwback rules to recapture state sales tax revenue from corporations that did not have an economic nexus in other states where their sales occurred.

To understand the throwback rule, it is important to clearly define a concept known as “nowhere income” or the income that corporations make that is not taxed for the two reasons below. Corporate income can be classified as nowhere income in one of two situations:

- The destination state doesn’t have a corporate income tax.

- The company’s activities in the state aren’t sufficient to establish legal “nexus” for purposes of the corporate income tax.

The Arkansas throwback rule states that sales by corporations originating in Arkansas to other states that satisfy conditions (1) and (2) above be “thrown back” to Arkansas to be eligible for taxation under the Arkansas corporate income tax.

Throwback rules are oftentimes inefficient and sometimes harmful when throwback-rule states attempt to court businesses to choose their state with such a convoluted tax law.

The pressure is even higher for states that utilize a single sales factor apportionment formula, such as Arkansas as of 2021. Apportionment essentially tells businesses that operate in more than one state how much of their sales are taxed in each state where they did business.

Therefore, only sales made inside the state contribute to taxable sales for multi-state corporations in Arkansas (as opposed to property and employee payroll, which is still used in some states).

Economists have found that states which emphasize sales in their apportionment formula tend to attract businesses that export most of their products or services to other states which emphasize sales in their apportionment formulas. This makes sense for exporting firms which have an economic incentive to locate to states that do not tax their goods and services as highly. Therefore, firms will be more likely to choose to locate inside a state that does not “throw back” their sales from other states and increase their corporate sales tax burden.

Research from economist Donald Bruce and co-authors found “no relationship between [the] imposition of a throwback rule and state tax revenue.” This means that states that adopt a throwback rule did not see any changes to their total tax revenue collection.

They also found that throwback rules “might raise effective business tax burdens and reduce economic activity.” This is due to the fact that firms always and everywhere seek to make a profit and will try to avoid anything that gets in the way of that goal. There is also anecdotal evidence from Arkansas that the throwback rule harms economic development. Other academic research has found that firms have an economic incentive to locate in non-throwback states with single sales factor apportionment formulas to avoid further taxation from a state that “throws back” sales from states where the firm does not have nexus.

Jared Walczak from the Tax Foundation, provided a hypothetical example of the impact of a throwback rule on business sales and found that if a business with $100 million in sales to 10 different states were located in a state with a throwback rule, then if “that state imposes a corporate income tax of 6 percent, the effective rate on the actual income earned in the state is an astonishing 38 percent—more than enough to convince many companies to locate their operations elsewhere.”

Summarizing the content above, throwback rules have been found to produce little to no benefit for states which adopt them. They increase the cost of operating an exporting business by imposing taxation on products and services (tangibles and intangibles) that would have otherwise been untaxed. If Arkansas wants to reduce barriers to doing business in the Natural State, repealing the throwback rule is a good first step. The Arkansas Department of Finance and Administration estimates HB1045 to cost $37 million in FY 2024 and $74 million in FY 2025. However, this is a static estimate and will be at least partially offset by new businesses locating to Arkansas as a result of the improved tax policy.

HB1044: Adopt Federal Depreciation Standards

Arkansas could also consider passing HB1044 which allows certain businesses to more fully deduct the cost of certain business inputs across the life of the assets in question. The bill also allows other corporations to claim a more specialized deduction, known as a bonus depreciation which “allows businesses to deduct a large percentage of the purchase price of eligible assets upfront.”

Allowing firms to claim the deductions found in HB1044 essentially reduces those businesses’ corporate income tax rate by allowing the expenses associated with running the business to be deducted from the total corporate income that is considered “taxable” by the state of Arkansas. This same type of tax saving could be realized by lowering the corporate income tax rate by an amount equal to the savings associated with the deduction.

Businesses change their investment patterns differently when the state reduces the corporate income tax rate than when it increases the number of business deductions available to a particular business. For instance, when a state reduces its corporate tax rate by 1 percent, businesses will invest 39 percent more than if the state increases business input deductions by the same amount, according to economist Eric Ohrn.

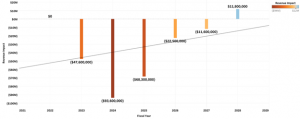

The fiscal impact of HB1044 is projected to be negative for the first five years as businesses adopt higher deductions and invest in more capital infrastructure, followed by a small revenue gain in 2028. However, the revenue loss is likely caused by deductions being taken earlier, and thus not being taken in 2028. Despite the lower results relative to corporate tax rate reductions, HB1044 will encourage Arkansas businesses to increase investment and reduce their corporate income tax burdens which will enable those businesses to free up resources which could be utilized to increase workers’ pay and training and advancement opportunities. The losses could be smaller than projected, since the DFA estimate doesn’t take into account any increased economic activity from the tax changes.

Figure I: HB1044 Revenue Impacts

Another major benefit of this bill is easy to understand: it makes sure Arkansas’s corporate tax rules are in-line with federal corporate income tax rules. Not only does this make compliance with tax law easier for businesses, but it helps businesses make long-term decisions about investment that only has to apply to one set of rules.

Summing It All Up

Eliminating the throwback rule and the franchise tax were two of the key corporate tax reforms recommended in 2016 by Dr. Jeremy Horpedahl along with authors at the Tax Foundation in our joint publication Arkansas: The Road Map to Tax Reform, and these reforms would be achieved by HB1044 and HB1045. The federal tax changes in 2017 have also made improving business deductions a priority in Arkansas to conform to federal taxes rules, which would be accomplished by HB1029. Arkansas has the opportunity to improve its corporate income tax code by passing these bills, implementing several reforms that don’t directly affect the income tax rate, but nevertheless make Arkansas a much more competitive state for business.