Dr. Jeremy Horpedahl, ACRE Scholar and UCA Associate Professor of Economics, recently appeared on the television program Capitol View with host Jay Bir. They discussed Arkansas’s tax system and how recently proposed changes by Gov. Hutchinson might impact Arkansas taxpayers and the state budget. You can watch the full interview online from KARK.

The changes proposed by the governor include lowering the top marginal personal income tax rate from the current 5.9% down to 5.3%, consolidating the lower- and middle-income tax brackets, and providing a small personal tax credit for low-income taxpayers. Horpedahl explained that all of these changes will benefit Arkansas taxpayers, especially those in the middle part of the income distribution who will benefit from both the rate cut and the bracket consolidation.

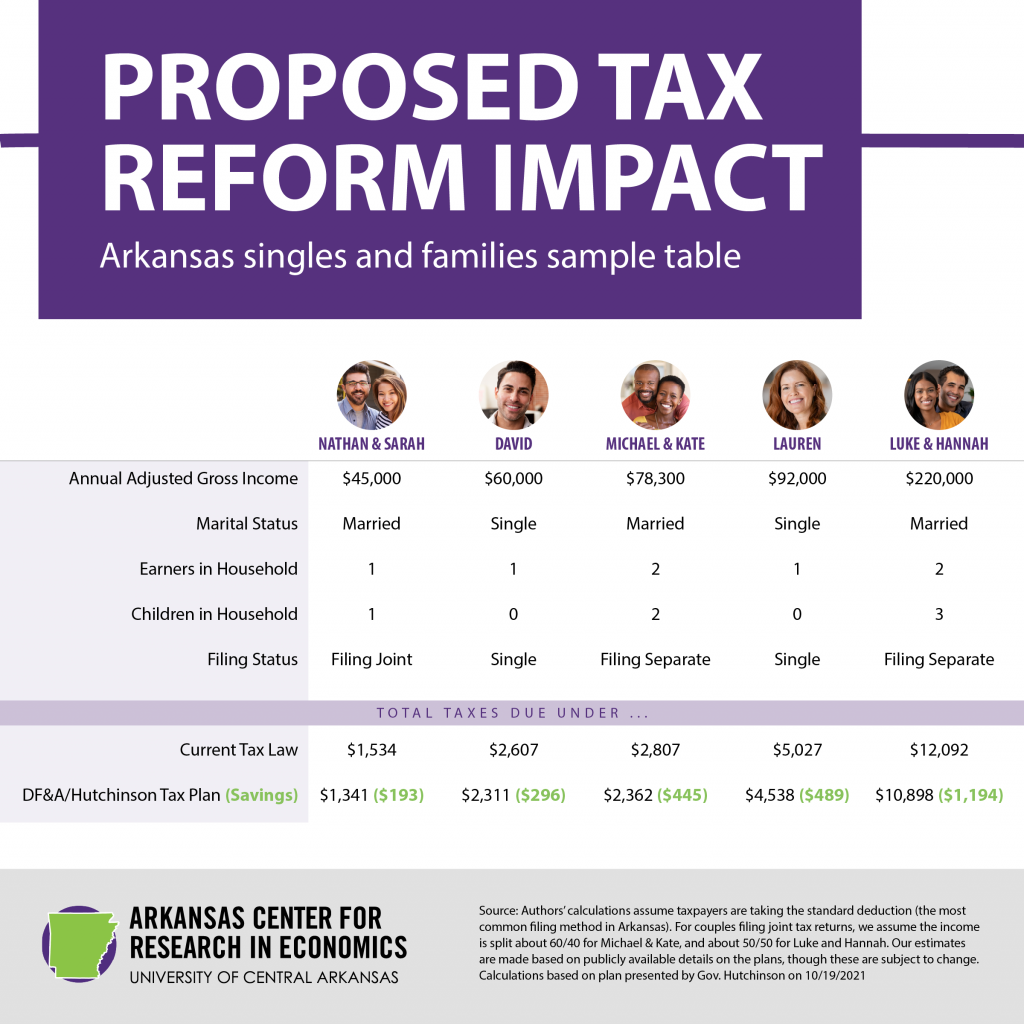

The table below shows how the proposed changes would impact five sample taxpayers throughout the income distribution in Arkansas.

The estimated budgetary cost of these changes would be about a $300 million decrease in the state’s general revenue budget. Dr. Horpedahl said that this is a large tax cut, about equal in size to all the tax cuts passed in the 2015, 2017, and 2019 legislative sessions. But Horpedahl also said this tax revenue reduction will not cause any major cuts in government services in Arkansas, since it is about the size of the normal annual increase in the general revenue budget in Arkansas. The tax changes are possible to enact by slowing the increase in the size of state government, but would not require major reductions in the roughly $6 billion general fund.

For more of ACRE’s work on taxes, transparency, and state finance, please see the following:

Shine More Light – Policy Analyst Mavuto Kalulu advocates for more state fiscal transparency in administering COVID-19 relief funds.

Reducing Arkansas’s Income Tax Rate To Zero – Dr. Jeremy Horpedahl discusses the steps necessary to completely repeal the Arkansas individual income tax.

The Road Map To Tax Reform in Arkansas – Dr. Jeremy Horpedahl outlines a series of reforms state lawmakers could enact to improve Arkansas tax policy.

Arkansans Could See Big Savings from Special Session – ACRE Policy Analyst Joseph Johns and Dr. Jeremy Horpedahl discuss how Arkansans could benefit from potential income tax cuts in the upcoming special legislative session.