By Joseph Johns and Jeremy Horpedahl

The Arkansas legislature may be meeting in the near future to consider changes to the income tax that individuals, families, and small businesses pay. So far we are aware of two potential plans to lower taxes, and more could be proposed at a special session this fall. The plans proposed are one by State Senator Jonathan Dismang and another by the Department of Finance and Administration (requested by Governor Hutchinson).

We wrote about this plans and other possibilities for Arkansas in our recent op-ed, “Lower the burden” published in the Arkansas Democrat-Gazette.

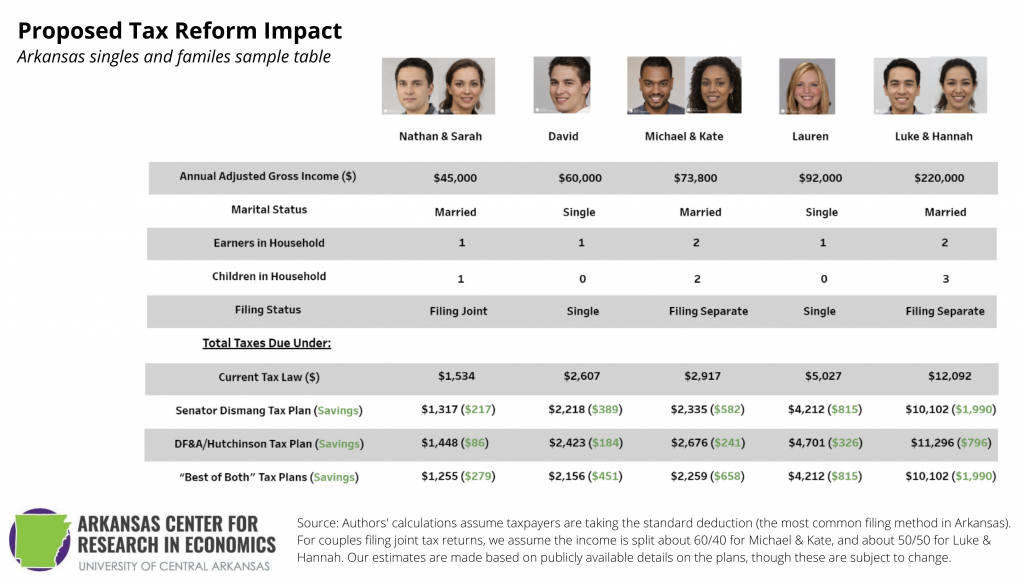

While the plans differ in specific details, both provide tax relief for both middle- and high-income earners. The table below shows how these proposals would lower taxes for different households in Arkansas, as well as a third plan which combines elements of both plans.

As we explain in a recent op-ed for the Arkansas Democrat-Gazette, any tax relief is great news for Arkansas taxpayers, as it allows them to control more of their own earned income. The median household in Arkansas could expect around $300 in tax savings each year if the most aggressive parts of both plans are enacted, and many other families could receive tax cuts even larger than those shown in the table above.

Creating an environment conducive to household and personal economic growth is a good goal for the legislature to consider during the upcoming special legislative session. These tax cuts come after three previous sessions where legislators reduced Arkansas taxpayer burdens. Households could be poised to receive even more relief in the coming weeks.

Details of the Plans

The first plan is proposed by Senator Jonathan Dismang [R-Searcy] and would consolidate the low- and middle-income tax brackets, and lower the top marginal income tax rate from 5.9 percent to 4.9 percent by 2026. The Dismang Plan would eliminate the tax cliff between the low- and middle-income tax bracket by merging them together. This would help those who choose to work more and who could be on the hook to pay more in taxes for earning just slightly more money this year.

The second plan from Governor Hutchinson and Department of Finance and Administration (DF&A), would keep the three-bracket structure, and lower the top marginal income tax rate from 5.9 percent to 5.5 percent by 2023. This Plan would also lower the 5 percent tax rate on income between $22,900 and $38,499 to 4.5 percent by 2023. This plan has a few more details that would include some modifications to rates in the lower-income bracket, as well fixing the income tax cliffs between the low- and middle-income sets of tax brackets.

Lowering the individual income tax and consolidating the overly complex three bracket structure will make Arkansas more competitive with its neighboring states as well as other southern states. For instance, North Carolina recently reduced its individual income tax to a flat tax of 5.25 percent, and several of Arkansas’s neighboring states already passed tax cuts in 2021. Arkansas is in a very competitive tax environment. As we stated in our op-ed:

our neighbors aren’t standing still either: Mississippi has seriously considered eliminating their income tax. Oklahoma recently lowered their top rate to 4.75 percent, and Missouri will lower their top rate to 4.8 percent over the next several years (using revenue triggers, something discussed in the Arkansas plans too). Voters in Louisiana will soon decide whether to lower their top rate down to 4.25 percent, which would once again make Arkansas the highest in the region if we make no changes. Even Tennessee, where they have never had an income tax on wages, finished phasing out their tax on investment income this year.

In ACRE’s 2016 book, Arkansas: The Road Map to Tax Reform, published jointly with the Tax Foundation, we suggested that Arkansas could lower its top income tax rate to 5 percent from the then 6.9 percent level to be more competitive in our region. At the time, our neighbors with income taxes had rates of either 5 or 6 percent. Given the recent changes in other states, our previous recommendations have even more importance today.

Of the two plans, Senator Dismang’s is more comprehensive and would provide larger tax cuts for middle- and upper-income taxpayers. This larger tax cut also means a larger reduction in state revenue, about $400 million in the long run versus about $200 million under the DF&A. Low-income Arkansans, those who earn less than $22,900 per year, would have the same tax burden under Senator Dismang’s plan, though they may see some relief under the DF&A/Hutchinson Plan.

Governor Hutchinson said he is willing to reduce top marginal rate as low as 4.9 percent as long as spending on education and healthcare are protected with special fiscal rules known as revenue triggers. Tax triggers require specific revenue targets to be met before tax cuts would come into effect to allow rates to fall further. The triggers would smooth state spending and avoid revenue shortfall perils that come with automatic, mandatory reductions in income tax rates.

Other Ideas for Tax Relief

Aside from revenue triggers, the Arkansas General Assembly could also consider taking up ideas from the last legislative session to provide further income tax relief. One such idea is to double the standard deduction for single and married filers. Rep. David Ray filed a bill during the 2021 regular session that would have made this change. If this were the only change legislators decided to resurrect, a married couple earning $50,000 with one child would save around $260 a year just from this change.

If legislators decided to both adopt Senator Dismang’s tax plan and double the standard deduction, a married couple with $45,000 of income (Nathan and Sarah in our sample table) could expect to save around $432 per year under the combined Dismang-Doubled Standard Deduction plan (about $200 of that comes from the standard deduction change). A married couple filing separately with three children who earns $220,000 (Luke and Hannah in our sample table) could expect to pay around $2,200 less in income taxes under a hypothetical Dismang-Doubled Standard Deduction tax change (again, about $200 is from the standard deduction change).

The state of Arkansas is also more fiscally prepared than it ever has been to implement more income tax reforms due to the robust $1.2 billion balance of the Long-Term Reserve Fund (LTRF), a fund which didn’t even exist prior to 2016 when Governor Hutchinson began championing the idea of a budge stabilization fund. ACRE Director Dr. David Mitchell recently extolled the merits of legislative rules that ensure this fund is only used for true fiscal emergencies. Tax cuts should be made in a way that does not jeopardize the soundness of Arkansas’s balanced budget, but the LTRF’s robust balance could be used as a backstop for any unexpected revenue declines due to future economic downturns.

Finally, Arkansas needs to be able to compete with its neighbors for talent and jobs. Two of our neighboring states, Tennessee and Texas, have no state income tax and balance their budgets without it. In the long run, Arkansas could do the same if it pursues responsible state spending patterns and prudent tax reforms now. A recent Talk Business and Politics poll shows strong support for the general idea of eliminating the personal income tax in Arkansas.

For more of ACRE’s work on taxes, check out the below links:

Tax book: The Road Map to Tax Reform in Arkansas

Research paper: Lessons From Other States Tax Reform Attempts

More on State Taxes and Spending