By Caleb Taylor

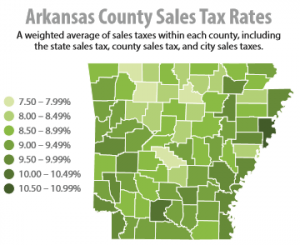

Arkansas legislators will make another attempt to rein in local special elections that have contributed to Arkansas having the third highest state and local sales tax rate in the nation at 9.51%.

House Bill 1368 by State Rep. David Ray R-District 40 would limit special elections to primary and general election dates in even-numbered years; or during odd-numbered years, when no primaries and general elections are held, on the third Tuesday in May or the first Tuesday in November. Some flexibility is allowed within the legislation including for natural disasters and health and safety concerns, or to fill vacancies in office.

The bill is scheduled to be considered by the House State Agencies and Governmental Affairs Committee at 9:30 a.m. Wednesday. You can livestream the meeting here. (HB 1368 passed the State Agencies and Governmental Affairs Committee by voice vote. The bill failed on Thursday, February 4 in the House by a vote margin of 40-49, but will possibly come up for a vote again this week.)

Currently, cities and counties have a great deal of discretion when deciding when to hold special elections.

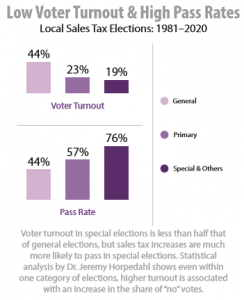

Based on research by UCA Assistant Professor of Economics and ACRE Scholar Dr. Jeremy Horpedahl, ACRE recently released an updated infographic containing turnout data in these elections and an illustration of where Arkansas’s average sales tax burden ranks compared to the rest of the nation.

Dr. Horpedahl found that voter turnout in special elections is less than half of the turnout in general elections. Sales tax increases are much more likely to pass in special elections than in general elections, which is likely due to the lower turnout. Even within election types (for example, looking only at general elections), higher turnout is also associated with fewer tax increases passing.

When sales tax votes are held at the same time as a general election, voter turnout is higher — about 44 percent on average. When elections are held at “special” times, voter turnout averages about 19 percent.

The pass rate for sales tax increases is 76 percent in special elections but only 44 percent in general elections and 57 percent in primary elections. All numbers are based on city and county sales tax elections in Arkansas from 1981-2020.

Update: You can watch Horpedahl’s testimony here (starts at 10:50:00).