By Caleb Taylor

Arkansas is tied with Tennessee for having the highest average state and local sales tax rate at 9.47 percent, according to a midyear 2019 state and local sales tax report by the Tax Foundation.

ACRE Scholar and Assistant Professor of Economics Dr. Jeremy Horpedahl discussed the relationship between Arkansas’s high sales tax rate and special elections in an interview with Paul Harrell on Conduit News on Thursday, July 18.

Special elections are elections held for a specific purpose that occur on dates other than primary or general election dates.

Horpedahl attributes Arkansas’s high sales tax burden partly to local governments having “a lot of discretion” to hold elections on sales tax increases throughout the year. While most states allow some kinds of local-option sales taxes, Arkansas is one of just 16 states that give many kinds of local jurisdictions a large degree of discretion with these taxes.

Horpedahl said:

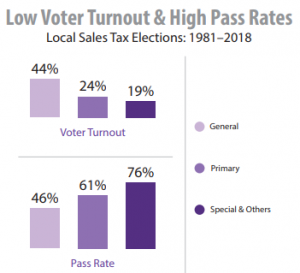

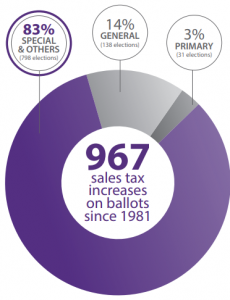

Most of these sales tax special elections…almost all of them, 83 percent, take place during some time other than the general or primary election. What we also found is that voter turnout is much, much lower during these special elections. We found that on average voter turnout is only 19 percent for these special elections while it’s over 40 percent for general elections. Finally, these sales tax increases are much more likely to pass during a special election. Three-fourths of them pass if they’re during a special election and fewer than half of them pass if it’s in a general election.”

For more, check out our one page summary of our research on this topic.

Former ACRE Program and Research Assistant Aaron Newell’s op-ed, “Not So Special Elections,” published by Arkansas Business on March 11th, discusses our research and legislation that would’ve limited special elections to primary and general election dates with certain exceptions.

You can also watch Horpedahl’s testimony regarding his research on special elections and sales taxes at a House State Agencies and Governmental Affairs committee meeting on February 13 starting at 10.25.55.