By Caleb Taylor

Arkansas legislators made many improvements to the tax code during the 2019 legislative session, but is there more to be done?

ACRE Scholar and UCA Assistant Professor of Economics Dr. Jeremy Horpedahl and the Tax Foundation’s Vice President of Federal and Special Projects Nicole Kaeding answer in the affirmative in “Talk about taxes,” an op-ed published on May 31 in the Arkansas Democrat-Gazette.

Horpedahl and Kaeding begin by outlining numerous changes the Legislature made to the tax code in the 2019 session. These include dropping the corporate income tax rate from 6.5 percent to an eventual 5.9 percent, enforcing a sales tax on Internet purchases, and increasing gas and diesel taxes. For a full summary of the many tax changes during the previous session, check out Horpedahl and Kaeding’s blog post at the ACRE Review on April 11th.

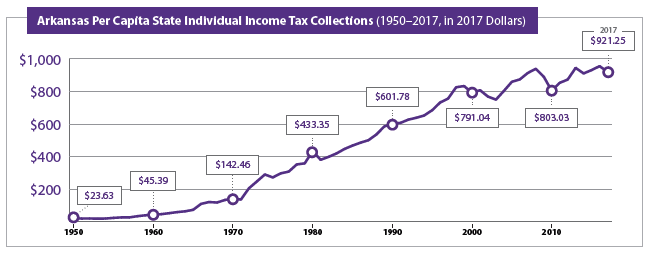

However, Horpedahl and Kaeding spent most of the op-ed explaining one change: individual income tax cuts.

Horpedahl and Kaeding said:

Changes to the individual income tax will most directly impact your budget. In 2019, the Legislature once again reduced individual income-tax rates, the third time since 2015. The most recent changes primarily impacted high-income Arkansans, but what are the cumulative changes since 2015? For a single taxpayer earning $20,000, income taxes in 2021 (when the law is fully phased in) will be about $154 less than without these changes. That’s a 30 percent cut in the amount of income taxes paid. A single individual earning $50,000 will see a $333 cut in 2021 compared with 2015, or about a 14 percent cut. A single individual earning $100,000 will have the income tax bill lowered by $367, or a 6 percent cut. And since Arkansas has no marriage penalty, two-income households can roughly double these amounts.”

Legislators should improve on these reforms by following the advice in Arkansas: The Roadmap to Tax Reform, written by Horpedahl and Tax Foundation experts, and use revenue gains from broadening the sales tax base to further reduce the top individual income tax rate.

Generally speaking, income taxes are more harmful to the economy than sales taxes, because income taxes reduce the incentive to work and create or expand businesses. Shifting the tax burden in this way would create more jobs and investment in the state without reducing government revenue.

Horpedahl and Kaeding said:

First, we argued that it is very possible to reduce the top income-tax rate to 5 percent, as well as lower other income-tax rates. Important progress was made in this area, but Arkansas still has four neighboring states with lower individual income-tax rates (two at zero percent). We also recommended extending the sales tax to a number of goods and services that are currently exempt or partially exempt. While the second recommendation may seem like a big tax increase, these two ideas are linked: broadening the tax base allows us to lower tax rates while keeping overall government revenue relatively constant.”

You can read their entire op-ed here.

For more of ACRE’s work on taxes, check out the below links:

The Road Map to Tax Reform in Arkansas

Lessons From Other States Tax Reform Attempts

More on State Taxes and Spending