By Aaron Newell

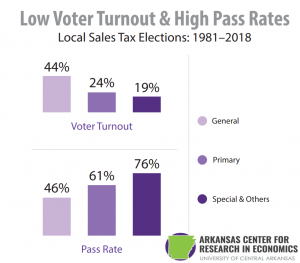

On February 13th, Rep. Justin Gonzales, R-Okolona, presented House Bill 1402 in front the House State Agencies Committee, which would limit special elections to just two dates a year – either at a primary or general election, or their corresponding dates in off years. Dr. Jeremy Horpedahl was invited to testify to the committee about his research on special elections. He explained how low voter turnout is during special elections (19%) compared to general elections (44%), and how the pass rate is much higher during special elections. He’s quoted in Jeannie Roberts’ article, “House’s Bill 1402 would narrow days for special elections” in the Arkansas-Democrat Gazette about the committee meeting.

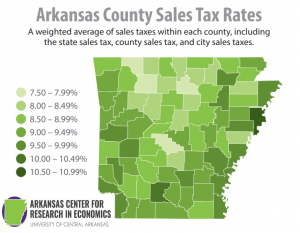

Arkansas has the third highest combined state and local sales tax rate in the nation at 9.43%. One reason for that is special elections. In 1981, the Arkansas legislature began allowing cities and counties to increase their sales tax rate and many did. 83% of the time, these increases are voted on during special elections. Special elections are usually single issue elections that happen outside of regular voting at a primary or general election. How important are special elections to the increases in taxes? In 2016, UCA assistant professor of economics and ACRE Scholar Dr. Jeremy Horpedahl and Alexandria Tatem, a UCA Schedler Honor’s College student and an ACRE student worker (who has now graduated), began gathering data on all sales tax elections in Arkansas since 1981, including ones at both special elections and normal elections.

What they found was interesting. Special elections to increase the sales tax have much lower turnouts and much higher pass rates than votes held at a primary or general election. Specifically, they found that voter turnout was 44% in general elections, 26% in primary elections, and 19% in special elections. The pass rate for these increases in the sales tax rate was 45% in general elections, 56% in primary elections, and 77% in special elections. It’s easy to see why Arkansas’s sales tax rate is so high, since 82% of all sales tax votes they collected occurred in a special election. Dr. Horpedahl also conducted statistical analysis with the data and found that turnout has an independent effect on the outcome. That means that even within special elections, higher turnout increases the share of “no” votes.

Dr. Horpedahl and I have updated the data to include elections through 2018. We collected data on 30 more elections, and the results still hold. The percent of special elections in the entire dataset increased to 83%, voter turnout stayed the same for general elections and special elections and decreased by 2% for primary elections, dropping to 24%. The pass rate for each election shifted slightly, moving general elections to a pass rate of 46%, primary elections to a pass rate of 61%, and special elections down to a pass rate of 76%. Please download our one page summary of the data to see more.

Dr. Horpedahl and I have updated the data to include elections through 2018. We collected data on 30 more elections, and the results still hold. The percent of special elections in the entire dataset increased to 83%, voter turnout stayed the same for general elections and special elections and decreased by 2% for primary elections, dropping to 24%. The pass rate for each election shifted slightly, moving general elections to a pass rate of 46%, primary elections to a pass rate of 61%, and special elections down to a pass rate of 76%. Please download our one page summary of the data to see more.

We have also mapped where the highest sales taxes are in the state. Below you’ll see a weighted average sales tax (which includes both county and city sales tax) for each county using county and city populations.

We have also updated the total estimated cost for hosting each election, based on data we obtained directly from local government statements for a sample of elections. Previously, the costs of all the special elections was $7.4 million, but after adding the new elections and updating the numbers for inflation, the total cost to taxpayers is $9.8 million for holding these elections. This is not just the cost of doing business or the cost of democracy – this is money that could be completely saved if the elections were to be held at the same time as primary or general elections.

We have also updated the total estimated cost for hosting each election, based on data we obtained directly from local government statements for a sample of elections. Previously, the costs of all the special elections was $7.4 million, but after adding the new elections and updating the numbers for inflation, the total cost to taxpayers is $9.8 million for holding these elections. This is not just the cost of doing business or the cost of democracy – this is money that could be completely saved if the elections were to be held at the same time as primary or general elections.

The cost of allowing these special elections is high. It is part of the reason that Arkansas has the third highest sales tax burden in the country. 83% of sales tax increase ballot issues have been held at a special election, and since these elections have low voter turnout and a high pass rate, Arkansas’s sales tax burden has been creeping upward and upward. In addition to the cost a high tax burden imposes, taxpayers have also paid nearly $10 million for elections to increase their taxes.

Currently, cities and counties have a great deal of discretion when deciding when to hold special elections. Arkansas lawmakers considered a bill in 2017 that would change the timing of special elections. SB723 was designed to increase voter turnout by requiring that all special elections must be held at a primary or general election in even years, and in May or November in years without a primary or general election. Arkansas lawmakers considering similar legislation should understand the costs and benefits of allowing these special elections when considering changing the law concerning special elections. Limiting the timing of special elections to general and primary election dates would increase voter turnout, lower sales taxes in the long run, and save money by eliminating the need to pay for separate elections.

You can find a video of Dr. Horpedahl’s testimony here, starting at 10.25.55

You can find more of Dr. Horpedahls’ research here

You can find more of ACRE’s research on taxes and spending here