By. Caleb Taylor

Where do Arkansas’s finances rank nationally?

Olivia Gonzalez, a research associate for the State and Local Policy Project at the Mercatus Center at George Mason University, spoke Thursday, November 29th about Arkansas’s fiscal health and ranking in the COB Auditorium.

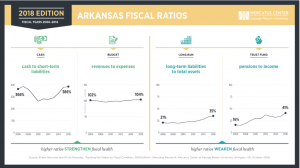

According to the Mercatus Center’s latest state fiscal rankings, Arkansas ranks 25th for fiscal health. Neighboring states that rank in the top five in fiscal health are Tennessee and Oklahoma.

The study analyzes state finances on five dimensions, then combines them to produce an overall ranking.

- Cash solvency: Does a state have enough cash on hand to cover its short-term bills?

- Budget solvency: Can a state cover its fiscal year spending with revenues, or does it have a budget shortfall?

- Long-run solvency: Can a state meet its long-term spending commitments? Will there be enough money to cushion it from economic shocks or other long-term fiscal risks?

- Service-level solvency: How large a percentage of personal income are taxes, revenue, and spending? How much “fiscal slack” does a state have to increase spending if citizens demand more services?

- Trust fund solvency: How much debt does a state have? How large are its unfunded pension and healthcare liabilities?

Gonzalez’s main suggestions were to improve Arkansas’s fiscal health by increasing Arkansas’s rainy day fund and making sure that Arkansas is planning for longer-term financial commitments like pensions and implementing tax reform correctly.

Gonzalez said:

You can’t really talk about the fiscal health of a state without talking about tax reform. When North Carolina implemented their tax reform they mostly lowered the rates, broadened the base and kept an eye on their expense side. Kansas on the other hand lowered tax rates, but they also narrowed the tax base even more and didn’t really keep an eye on the spending side of the equation. When you implement tax reform without taking into consideration your spending issues, you have more revenue-neutral or revenue-negative results.”

UCA Assistant Professor of Economics and ACRE Scholar Jeremy Horpedahl and Nicole Kaeding, Director of Special Projects at the Tax Foundation, expand on this idea and more in a research paper Learning from Other States’ Successes and Failures in Tax Reform released in May, 2018.

Horpedahl and Kaeding show that there are important lessons for Arkansas legislators to learn from other states and principalities when considering how to proceed on tax reform. Utah, Indiana, North Carolina and the District of Columbia implemented “smart, sensible” tax reform measures that can “dramatically improve competitiveness.” While the authors list multiple examples Arkansas should emulate, they also tell a cautionary tale about the “haphazard” tax reform efforts in Kansas mentioned by Gonzalez.

Gonzalez recommended states treat their finances like like a budget-savvy individual would treat their personal finances.

Gonzalez said:

State finance should be pretty straightforward. Things that matter for your personal finances like having enough cash on hand to pay short term bills, having more money coming in than you have going out and not paying for previous debt with new debt. These kind of common sense things matter for your state finances just as much as they do for personal finances.”

You can watch her full talk below:

For more on this topic, visit our taxes and spending research page.