By Caleb Taylor

Arkansas dropped three spots from 43rd to 46th from 2018 to 2019 in the Tax Foundation’s annual Small Business Tax Climate Index.

The report was released on September 26th and is authored by the Tax Foundation’s Jared Walczak, Scott Drenkard and Joseph Bishop-Henchman.

According to the authors, the index is “designed to show how well states structure their tax systems and provides a road map for improvement.”

Arkansas is ranked 46th in the 2019 Business Tax Climate Index. Taxes factored into the score include corporate income (40th), individual income (40th), sales (44th), property (26th) and unemployment insurance (34th). Being ranked 46th means that only 4 states are worse than Arkansas (they are Connecticut, New York, California, and New Jersey).

Nicole Kaeding, Director of Special Projects at the Tax Foundation, told legislators at an Arkansas Legislative Tax Reform and Relief Task Force meeting on September 26th that the drop in rank was mainly a result of other states reforming their tax code recently.

Kaeding and ACRE Scholar and UCA Assistant Professor of Economics Jeremy Horpedahl discuss some of the reforms other states have made to their tax code in Learning from Other States’ Successes and Failures in Tax Reform. Their op-ed on the same topic, “Reform Taxes Now,” in the Arkansas Democrat-Gazette on May 21st can be read here.

Kaeding told legislators:

Your score did fall by three spots. It was largely not because you all made changes, but it was that other states moved ahead of you. Arkansas is falling behind because you’re standing still.”

The task force approved the so-called “Option A” plan on August 22nd to reduce the top individual income tax rate from 6.9 percent to 6.5 and consolidate its rate schedules. The plan would cut taxes for individuals by about $260 million with $100 million of that total going to middle income earners.

However, a separate plan released by the Department of Finance and Administration (DF&A) is also being considered. This plan would reduce the top individual rate even further, to 5.9 percent, while also increasing the standard deduction for taxpayers.

Kaeding said:

All else being equal, I’d pick the DF&A plan over Option A. It goes a long way to simplify your individual income tax structure, resulting in fewer brackets. It also, on a revenue basis, has a bigger bang for its buck.”

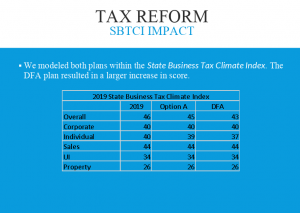

In her presentation to legislators, Kaeding noted that both plans would improve Arkansas’s overall tax competitiveness as measured by the Tax Foundation’s Small Business Tax Climate index. The plans would improve Arkansas’s corporate and individual income tax rankings while sales, unemployment insurance and property tax rankings would remain unchanged.

More of ACRE’s research on taxation can be found here. Kaeding and Horpedahl were co-authors of an op-ed published in the Arkansas Democrat-Gazette entitled “Tax cuts for thee? What changes mean for Arkansas” on September 13th. Note that this op-ed was written prior to the new Tax Foundation data release, and Arkansas’s 39th rank on the previous version of their Index is not directly comparable to the current rank.