By Mr. Jacob Bundrick

If you’ve ever wondered why corporate welfare gets such a bad rap, you’ll want to read this post and the five follow-up posts I’ll be publishing over the next few weeks. My goal is to help you understand why governments give tax breaks and subsidies to local businesses and why, even with the best of intentions, these efforts tend to fail and cause new problems. These posts are based on a paper I just published, “Tax Breaks and Subsidies: Challenging the Arkansas Status Quo.”

Economic development is a constant focus of state and local governments. Government officials work to attract businesses, jobs, and investment to the area. They often do this by offering financial incentives, such as tax breaks and subsidies, to select firms. However, financial incentives used to entice businesses come at the taxpayers’ expense. Politicians may enjoy bragging about the remarkable progress they’ve made when they trade tax dollars for a handful of jobs, but they ignore the resulting economic costs. Tax incentives create market distortions that make residents worse off and leave them with less money in their pockets.

Here at ACRE, we want Arkansans to be as well off as possible. To ensure that they are, we want to help you understand the problems with financial incentives, why you should care, and what government officials should do instead to create the best outcomes for each individual Arkansan, their families, and the state as a whole.

What Are Tax Incentives and Subsidies?

When trying to improve economic development, politicians and government officials frequently use two carrots to entice firms: tax incentives and subsidies. Tax incentives aim to attract more business to the state by making it less expensive for businesses to operate in Arkansas relative to other states. Subsidies are grants, or sums of money, that governments give firms in an effort to boost business. Let’s take a look at how each one works.

Tax incentives are always designed to increase a firm’s profitability by decreasing its overall tax burden. They come in several forms:

–Tax exemptions fully excuse firms from paying certain liabilities.

–Tax reductions partially offset the amount a firm is obligated to pay in taxes.

–Tax refunds and rebates repay a portion of the taxes a firm has already paid.

–Tax credits are more flexible: they allow a firm to offset a portion of its tax obligation, and they can often be carried forward to subsequent tax years or be sold in the secondary market.

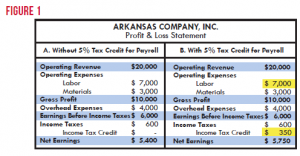

To see how tax credits can impact a company’s profitability, take a look at this sample profit and loss statement. The yellow highlights show how a business income tax credit, in this case for labor, increases a firm’s bottom line.

How Do Businesses Get Tax Incentives?

To receive tax incentives, firms must meet certain requirements from the government. These vary depending on the tax incentive, but common ones include:

-belonging to certain industries

-investing so much in a particular project

-creating a particular number of jobs

-reaching a minimum payroll threshold

The qualifications often depend on the tax incentive’s purpose, which might be creating new jobs, spurring private investment, or increasing research and development. After all, government officials use incentives to promote their particular agendas. Politicians can attempt to steer business practices with incentives because incentives encourage firms to engage in a specific activity by lowering the firm’s cost of that activity, making the return on investment more attractive.

For example, the Arkansas job creation tax incentive known as Advantage Arkansas is an income tax credit given to qualifying firms based on the payroll of new, full-time, permanent employees. Because the tax credit lowers the firm’s labor costs, the return on investment of hiring a new employee is greater and thus a more attractive option relative to other investments the firm could make. Most recently, Elyxor of North Little Rock, a software engineering, development, and deployment firm, is poised to benefit from Advantage Arkansas. Elyxor will receive an income tax credit for 1 percent of its total payroll. In return, the company plans to hire 45 employees within 5 years.

Using Tax Incentives to Target Preferred Businesses and Industries

Politicians commonly use tax incentives to target certain preferred businesses or industries in which they want to encourage the creation, expansion, or relocation of firms. This targeting is an attempt to steer the economy by lowering the cost of doing business in a desired industry. For example, Arkansas provides targeted tax incentives to six emerging technology sectors:

-advanced materials and manufacturing systems

-agriculture, food, and environmental sciences

-bio-based products (adhesives, biodiesel, ethanol, etc.)

-biotechnology, bioengineering, and life sciences (genetics, geriatrics, oncology)

-information technology

-transportation logistics

Tax incentives aren’t the only tool governments and politicians can use to attract business: they can also use subsidies.

How Governments Use Subsidies to Attract Business

Often, governments issue subsidies under the premise that firms will create jobs or increase investment in the local economy. Subsidies, much like tax incentives, lower the cost of doing business and increase returns on investment. The potential for new jobs and investments to improve economic development makes subsidies an attractive tool for politicians.

Arkansas frequently provides subsidies through the Governor’s Quick Action Closing Fund (QACF). Both the governor and the legislative council must approve the Arkansas Economic Development Commission’s use of the QACF. The QACF is funded with general revenues, which are funds that come primarily from individual income taxes and sales and use taxes. The legislature allocates these funds across the state’s agencies and programs, including to the QACF. [Related: Making Cents of $18 Million: Voters Decide Whether to Increase Sales Taxes in Pulaski County.]

From its creation in 2007 through end of fiscal year 2015, the QACF has subsidized 73 entities. Some of the largest beneficiaries include Hewlett-Packard in Conway ($10 million), LM Windpower in Little Rock ($6.8 million), and Nordex in Jonesboro ($3.8 million).

Arkansas’s government also provides subsidies through Amendment 82 bonds. Amendment 82 of the Arkansas Constitution allows the Arkansas General Assembly to authorize the issuance of general obligation bonds of up to 5 percent of the state’s general revenues collected during the most recent fiscal year (in Arkansas, the fiscal year runs from July 1 to June 30; fiscal year 2016 started on July 1, 2015, and ended June 30, 2016). Amendment 82 bonds are generally reserved for “major economic development projects,” such as the $125 million subsidy to Big River Steel in Osceola. For a company to receive Amendment 82 bonds, the general assembly must approve the bonds’ issuance by a vote. Because these bonds are general obligations of the state, they become a liability of the taxpayers. In other words, it’s your tax dollars that must pay off the debt the state legislature voted to place on you. Legislators have to find the money for these bonds somewhere, which means they could cut spending elsewhere or, more likely, raise taxes.

Conclusion

Rather than focusing on developing the next special tax break or subsidy, government officials should focus on creating a better business environment to attract and retain businesses. Specifically, Arkansas should implement comprehensive tax reform that not only lowers taxes for all businesses, but creates a more simple, fair, and transparent system.

Stay tuned for my next post, where I’ll discuss why financial incentives don’t have the positive effect on economic activity that their supporters think they do.