By Caleb Taylor

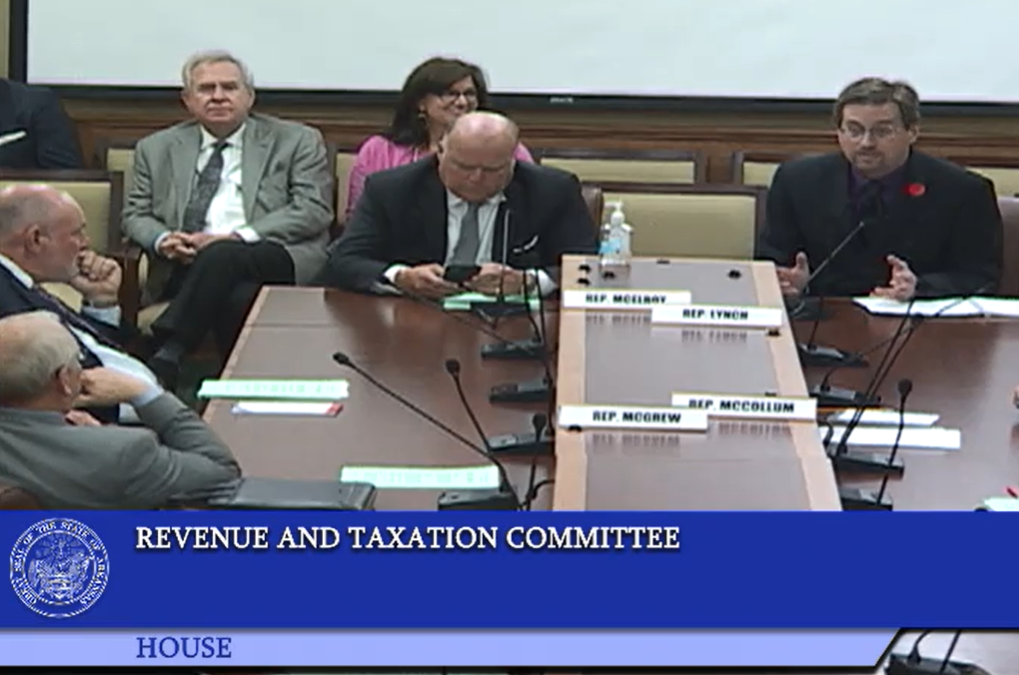

ACRE Legislative Research Associate Nathan Smith recently testified against legislation expanding tax credits for some businesses in Arkansas.

Smith said the bill would be “basically just a giveaway of millions of dollars a year to shareholders of these companies.”

Senate Bill 543 sponsored by State Sen. David Wallace and State Rep. Joe Jett was considered and passed by the House Revenue and Tax Committee on Thursday, April 15.

According to the Arkansas Democrat-Gazette:

Senate Bill 543, by Sen. David Wallace, R-Leachville, would allow for recycling tax credits to be calculated at 30% of the expense of the eligible equipment for qualifying projects.

Wallace said his bill aims to assist Big River Steel in Mississippi County.

The income tax credit is available under current law to qualified steel specialty products manufacturing facilities that started construction on or after Jan. 1, 2017, with a closing date before July 1, 2018, the finance department said.

SB543 would extend the credit to such facilities that start construction on or after Jan. 1, 2021, with a closing date before July 1, 2023.”

Jett said to qualify for the tax credits a business would have to have a project of at least a $200 million investment and 150 new jobs with an average salary of $75,000 per job.

Smith said, based on dividing the size of the tax credit by the number of jobs required, the legislation would lead to the state effectively paying 44 percent of the wages in the target jobs.

Smith said:

Lots of employers would love to have 44 percent of their wage bill covered by the state but we can’t afford to do that for everybody so in practice it only gets done for a privileged few. That’s not a good way to do business.”

Smith also said the lost revenue from the legislation “could better be used for state infrastructure needs or income tax cuts.”

Smith said:

These types of incentives are usually not pivotal in business decisions. If you give a tax break to a business to do what you’d do anyway, that’s basically just a giveaway of millions of dollars a year to shareholders of these companies. There are better things you can do with this money.”

You can watch his full testimony here. Smith’s testimony begins at 5:56:21 p.m.

You can find more of our research on economic development incentives here.