Landmark PLC, Certified Public Accountants has given $50,000 to the University of Central Arkansas College of Business Enhancement Fund.

The enhancement fund supports student programming, enhanced learning opportunities, as well as professional development opportunities for students, faculty, and staff in the College of Business.

“This gift from Landmark makes our college stronger in a number of important ways,” said Michael B. Hargis, dean of the UCA College of Business. “Our students will have greater access to learning opportunities outside the classroom as well as enhanced professional development opportunities for students. Learning inside the classroom will improve as well, as our faculty will have more funding to attend professional development opportunities and additional training to ensure our curriculum remains current and rigorous.”

Landmark is a full-service public accounting and business advisory firm with four offices throughout Arkansas in Little Rock, Rogers, Fort Smith and Russellville.

In addition to the gift to support the UCA College of Business Enhancement Fund, Landmark supports the Department of Accounting through the Blake Payne Memorial Endowed Scholarship, available to juniors and seniors majoring in accounting. The scholarship honors the memory of Payne, who was a UCA College of Business alumnus and worked at Landmark.

The UCA College of Business has more than 1,600 undergraduate and graduate students. It offers 14 baccalaureate degrees, two master’s, one graduate certificate and one technical certificate across four academic departments and houses the state’s only insurance and risk management program. The UCA College of Business is accredited by the Association to Advance Collegiate Schools of Business (AACSB). Visit uca.edu/business for more.

The University of Central Arkansas College of Business has hired two faculty members in its

The University of Central Arkansas College of Business has hired two faculty members in its

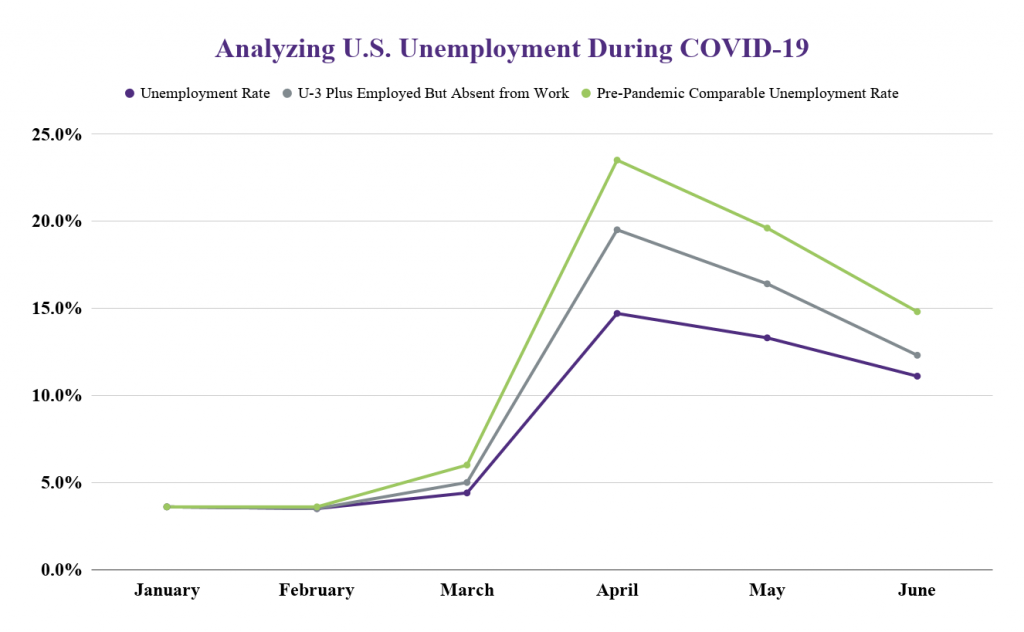

By Jeremy Horpedahl, Ph.D.

By Jeremy Horpedahl, Ph.D.

Japan is one of the world’s most advanced and largest economies, yet lags behind in its use of e-payment and e-commerce.

Japan is one of the world’s most advanced and largest economies, yet lags behind in its use of e-payment and e-commerce. Cynthia Burleson, director of the Center for Insurance & Risk Management in the UCA College of Business, was featured in June on an episode of the Insurance Town podcast.

Cynthia Burleson, director of the Center for Insurance & Risk Management in the UCA College of Business, was featured in June on an episode of the Insurance Town podcast.

Hannah Robinson, a senior

Hannah Robinson, a senior